3 Biggest Questions About Real Estate and Mortgages

As we near the end of 2022, the housing market is still in a constant state of shifts and changes. Some bigger or more impactful than others, but the truth remains the same: while we wish we had a crystal ball, we’ll never be able to predict what’s going to happen. However, one thing will always remain constant: people will always need a place to call home.

There are three big questions in real estate and in the mortgage industry right now. We’ll cover them here. So, before you hit the panic button, give this a read!

Will Mortgage Rates Continue to Rise?

To answer this question, it’s important to understand the why behind the reason mortgage rates have doubled since the beginning of the year and that’s due to inflation.

To ease inflation, the Federal Reserve is taking steps to tame inflation by slowing the economy. In turn, these decisions have an impact on mortgage rates. Until this is under control, we may continue to see rates stay high or rise even higher.

Despite the high mortgage rates, there is still opportunity in the real estate market.

“There is no doubt that the increasing mortgage rate will make homebuying even more challenging, . . . buyers may still find opportunities, as these changes coincide with the time of the year when buyers have historically found the best market conditions to obtain more bargaining power,” said Jiayi Xiu, economist for realtor.com.

What Will Happen to Home Prices?

Dave Ramsey sums it up: “The root issue of what drives house prices almost always is supply and demand.”

And when you look at the graph below, you’ll see why we have seen such a large slowdown in home price appreciation in the last few months.

The sudden uptick in mortgage rates and lingering inflation has changed the playing field in the housing market. So, as the pace of sales slows, the more active listings there are. That does not mean we’ll see national deprecation in home values.

Overall, experts are projecting continued price appreciation in most markets, averaging about 1.8% in 2023. However, there are some overheated areas where experts are projecting slight depreciation, but certainly not enough to call it a crash.

Should I Buy A Home Right Now?

Homeownership has many financial and non-financial benefits. It’s true that it costs more to buy a home today than it did last year, but the same is also true for renting. This means, either way, you’re going to be paying more.

Although affordability is challenging right now, buying a home helps you gain equity will will help grow your net worth.

The best way to answer this question is that homeownership will always win over time. It’s a long game.

You can choose to put your money over time into rent and not get a return or play the long game, invest in homeownership and benefit from your investment.

Bottom Line:

As we said before, we wish we had a crystal ball to predict what’s going to happen with mortgage rates or price appreciation, but we unfortunately can’t control that.

Remember, the team at Greenway Mortgage is always here to help answer any questions you have. We are happy to sit down with you to discus which home buying option best suites your scenario and find out how much home you can afford. We’re here to help.

Here are some helpful resources:

Conforming Loan Limits Increase to $715,000

At Greenway Mortgage, we’re passionate about opening doors for home buyers.

Recording-breaking home price appreciation in 2021 and 2022 has resulted in an increase in conforming loan limits.

To reflect changing home prices and to increase home buying power, we’ve increased our Conventional Mortgage loan limits to $715,000 which will give buyers more wiggle room to qualify!

Loan Limits Just Got Higher

Previously, conforming loans were available up to 647,200. With recent changes, that limit has increased to $715,000!

- 1 Unit: $715,000

- 2 Units: $916,000

- 3 Units: $1,107,000

- 4 Units: $1,376,000

What can this mean for homebuyers?

-

Clients can potentially borrow more through a conventional, typically lower rate loan.

-

Homebuyers may be able to access lower down payment options for larger loan amounts without paying mortgage insurance for the life of the loan.

-

Borrowers may be able to combine (or avoid) smaller 1st and 2nd mortgages.

If you have questions about this change, please reach out to the experts at Greenway Mortgage. And if you have friends who may benefit from the news, please pass it along. We are happy to help.

4 Biggest Real Estate And Mortgage Questions

It’s no secret the real estate market is in a constant state of shifts and changes. In uncertain times like these, naturally, questions will arise regarding rising rates, the housing market, and if we’re headed towards a recession.

Lately, there has been four big questions coming up that we’d like to help answer to ease any uncertainty, especially for those looking to purchase a home this year.

Let’s take a deeper look.

#1: What’s Happening with Mortgage Rates?

Rising mortgage rates are no doubt one of the biggest factors impacting the housing market right now. It is important to remember that the low rates of the last few years were an anomaly.

As inflation rises and mortgage rates climb, many may see their purchasing power shrink and their dream of homeownership fade.

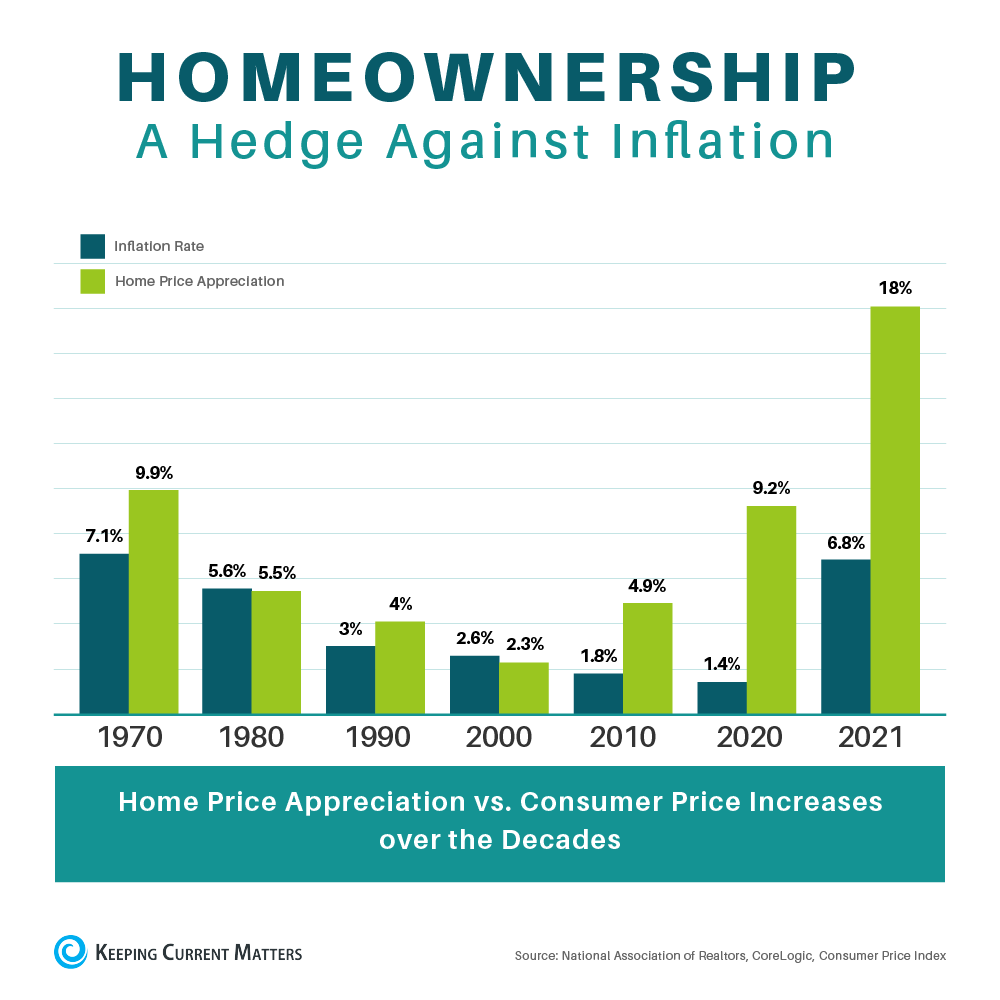

One big piece of economic wisdom: there is no better hedge against inflation than homeownership.

Historically, we have seen homeownership outperform inflation in most decades. So, if there’s an asset to invest in, housing is one of the few tangible assets that tends to hold its value.

We can’t control what’s going to happen with mortgage rates or price appreciation, but we can control what we prioritize. That way, in times of uncertainty, you see these factors less as stop signs and more as opportunities for growth and change.

#2: What Will Happen to Real Estate If There’s a Recession?

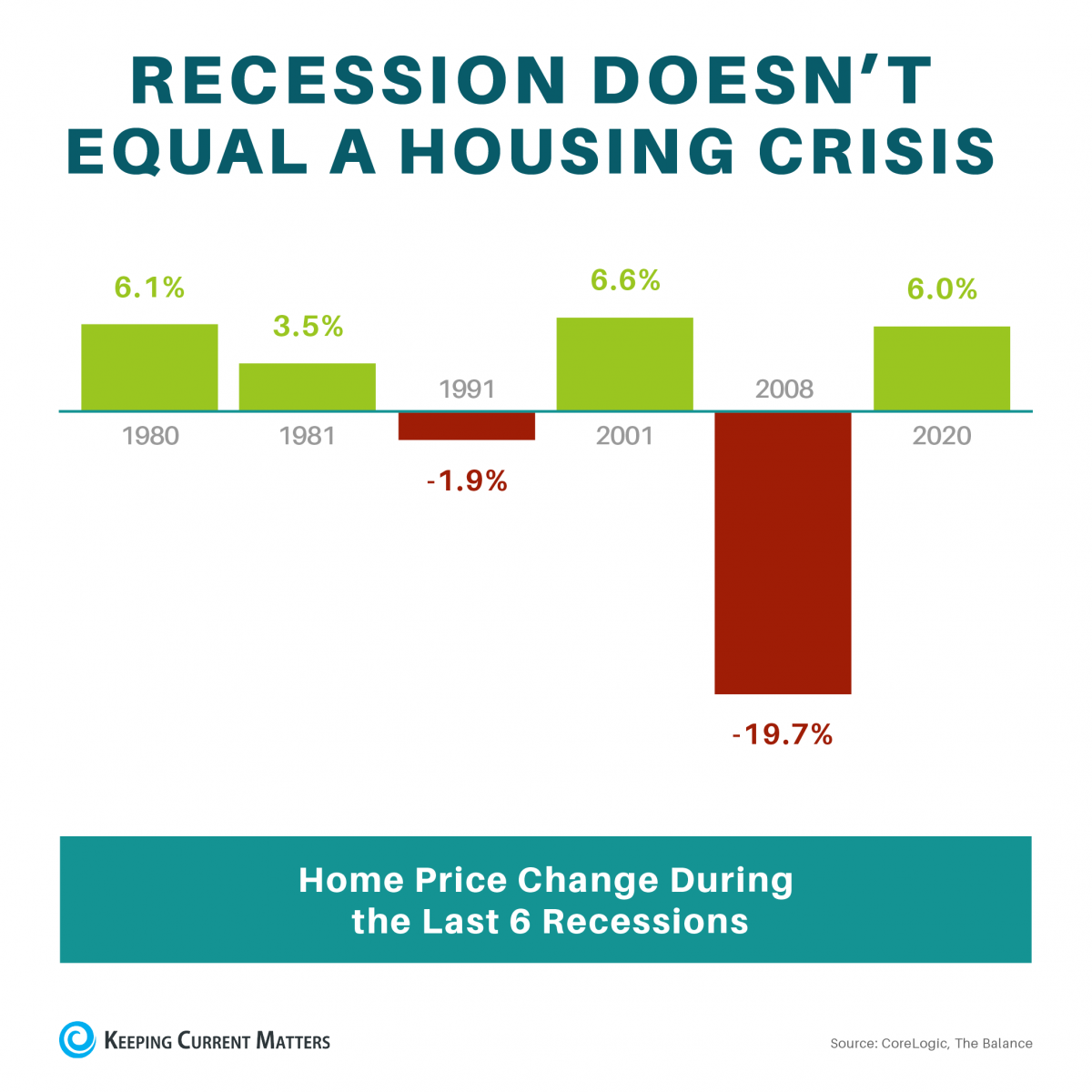

Post-2008, nothing will strike fear into the hearts of buyers and sellers like the word “recession.” But historical context is everything and this chart can give some serious perspective.

Home prices have continued to appreciate in 4 out of the last 6 recessions. If a recession happens, it does not necessarily mean home prices will decline. Rates usually rise at the beginning of an economic decline, but to stimulate the economy, they typically fall.

According to Fortune,

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

Now is a great time to reach out to see what home buying options are best for YOU.

#3: What’s Going to Happen This Year in Real Estate?

When we’re constantly being bombarded with different opinions and information, it’s easy to get lost in the noise.

While signs of a market shift become clearer each day, it’s important to remember that context is everything. Yes, we are seeing a slowdown. However, we are just heading back toward the marketplace we saw pre-pandemic, and those were still great years for real estate.

Focus on the big picture, and that’s this: the housing market is still very strong, and previous projections are already outperforming what industry experts forecasted earlier this year.

Yes, now is still the time to buy. We should start to see less competition, fewer bidding wars, and, therefore, less upward price pressure.

In fact, a simple analysis shows that a one-month increase in the months’ supply results in a 3% decline in annualized house price growth. And our preliminary house price index is already showing moderation in house prices in April.” —Mark Fleming, Chief Economist, First American

#4: Should I Buy a Home Right Now?

This is by far the most asked question of all. The short answer is Yes. However, the right time to buy is when YOU’RE ready.

.png)

Trying to time the housing market for that deal of a lifetime is like trying to win the lottery. And while purchasing a home today may not be as easy as it was a couple of years ago, the latest data shows that inventory levels are rising, which means more moderate price appreciation and more options for buyers.

Being prepared in this competitive real estate market is key. So, if you’re looking to buy soon, this is a great time to prepare for when the right home comes along. Here are a few tips:

- Having the right Loan Officer (we know a few 😉) and Real Estate Agent on your side is key to helping you navigate through the process.

- Get an upfront pre-approval. A pre-approval will help you better understand your budget and it helps your agent find that dream home. Plus, it’ll help you beat out the competition!

- To prepare for pre-approval gather the following docs: proof of income/assets, employment verification, credit history, ID, SS#.

- If you’re in search of a local Real Estate agent in your area reach out and we’ll connect you with some of our favorites. Contact us here or give us a call at (908) 489-4658.

Bottom Line:

Don’t let the headlines turn you away from your dream of homeownership. No one can control what’s going to happen with mortgage rates or price appreciation. Home prices could come down this year, inventory may open up and mortgage rates might start to drop.

Whether it’s a good time to buy a home or not depends on your personal financial picture. You’re in a strong position to buy a home if you have a steady job, a down payment saved up, a good credit score, and low levels of debt. If you’re not in an ideal to buy now take the time to prepare. Learn how to budget, save for a down payment and work on your credit.

Greenway Mortgage offers a wide variety of home loans. We have something for everyone. Give us a call and we’ll discuss which option is best for you!

Helpful Resources:

Visit us online for more information regarding loan programs and helpful resources to get you started!

Believe it or not, this ride isn't as scary as it may seem!

The media is talking about escalating home prices, rising mortgage rates and past housing bubbles. Let me tell you what we're seeing from the trenches of home financing. I think you'll like it.

Price growth is slowing.

After a record run of frenetically rising home prices, gains are slowing down. Homeowners still have newfound equity in their homes, and moderated prices can help new buyers.

Mortgage rates remain in the "low" range.

After a couple of years with extraordinarily low mortgage rates, 2022 has seen some increases, yet rates are still well below long-term averages.

While the Federal Reserve Board may continue raising policy rates to cool inflation, mortgage rates have largely reflected the changes already. Even with the increases, home price gains and other advantages can make owning a home better deal than renting.

What does all of this mean for you?

- A lot of existing homeowners are very comfortable right now. They've locked in a low interest rate and are enjoying fixed housing costs. Because of today's strict underwriting guidelines and due diligence, they're confident they have the income and resources to afford their homes.

- For most, their homes have gained significant value. This protects them in case prices fall and provides equity to access for emergencies, home improvements or other expenditures. If you're in this position, I can help you with a home equity loan or line of credit.

- For those still looking to buy, market forces are tilting toward more housing supply (which means less competition), price moderation, and rate stabilization. This combination invites buyers who previously shied away from the frantic market back in the game. If this sounds like you, I may be able to help extend your buying power with a hybrid adjustable rate mortgage that starts with a lower rate and payment.

In all types of markets, the team at Greenway Mortgage remains committed to helping you make the most of your home financing.

Any time we can assist you or someone you know, please reach out!

Most Medical Debts To Be Removed From Credit Reports

Changes are coming to medical debt reporting on consumer credit histories. In fact, credit scoring is changing to help consumers – specifically those with medical debt. That's not something you hear every day! Could a change in medical debt reporting help you? Read on for what borrowers should know about changes to how medical collections debt is reported.

Medical Debt is a Huge Element of Consumer Debt

When you think of consumer debt, overspending on credit cards may come to mind first. However, according to Consumer Financial Protection Bureau research, there’s $88 billion in medical debt on consumer credit records as of last June. COVID-19 sure hasn’t helped. Those with excellent credit records are sometimes dragged down by medical debt, too.

Having a debt in collections can eat away at your credit score by 100 points. Keep in mind, that these new changes will not erase medical debt. You're still responsible for paying it off.

What You Need To Know

The three primary credit repositories (Equifax, Experian and TransUnion) have agreed to changes that will wipe approximately 70% of medical collection debt from consumers' credit files. Here's what you need to know.

As of July 1, 2022:

-

Medical collection debt will be removed from credit reports after it has been paid. Typically, debt sent to a collection agency remains on a report up to seven years.

-

Negative reporting for unpaid accounts will appear on reports only after 12 months have passed. This gives consumers extra time to finalize questions with providers and insurers before the debt affects their credit rating.

-

Medical collection accounts below $500 will not be included on reports at all.

Bottom Line

If you or someone you care about has been denied credit or paid more due to a low credit score impacted by medical collection debt, it may be time to try again.

Please reach out with questions or to see if these changes may improve your credit scores. And if you know of anyone else who could benefit, please pass the information along or let us know. The Greenway Team is happy to help.

.png)

.png)

.png)