Home buying just got a lot easier!

The average borrower wants a conventional mortgage when they purchase a home. Rates are lower and the terms seem friendlier. What if you don’t have the standard 20% down payment, though? What if you only have 3% to put down – are you out of luck? The good news is there is a Conventional 97 program.

The Conventional 97 First-time Buyer Program helps more families achieve the homeownership milestone with a 3% down payment, regardless of income levels or geographic location. Many of today’s home buyers will meet guidelines for this new loan option.

Take a look at some of the criteria in order to qualify for this type of loan:

SOLUTION FOR DOWN PAYMENT CHALLENGES

- Minimum down payment: 3%

BROAD ACCESS

- No geographic restrictions or income limits

GETTING READY FOR HOMEOWNERSHIP

- Homeownership Education required

PROPERTY ELIGIBILITY

- Primary Single Unit Residences (including condos)

FINE PRINT & ELIGIBILITY

- At least one borrower must be a 1st time homebuyer (no ownership in last 3 years)

- Borrowers may not have any ownership in any other residential property at time of closing

- Non-owner occupant co-borrowers not permitted

- Homeownership education: Certificate required when all borrowers are first-time buyers, at least one borrower must complete the course

Have questions or need some guidance? Contact us today.

Are you getting ready to buy a home? If so, here are four keys to being prepared so you can make your very first offer!

1. Know what you can afford and how much cash you will need. Knowing what you qualify for before looking at any homes will save you the disappointment that can come from falling in love with a home that's out of reach. We'll be happy to "pre-qualify" you now so you'll know what will work later.

2. Know where you want to be. Learn about the neighborhood before you make an offer to buy. Sample the commute. Talk to would be neighbors. See the schools, shops and services before you start negotiating.

3. Choose your property type. Consider your range of choices: single family, multi-family, townhome, condo, co-op, new construction, etc. Know the pros and cons of each. Decide which is best for you, and define your search accordingly.

4. Obtain a valid pre-approval before you make an offer. This entails document verification, a credit check and automated or actual underwriting. If all is in order, you will receive the equivalent of a loan commitment that's subject to a contract, appraisal and title work. Your pre-approval gives you and the seller confidence in your ability to close the deal once you find your perfect home.

You will probably buy a home only a few times in your life, but we're laser focused on the process every day. We know how important proper preparation can be to making the process easy and rewarding. Now, so do you.

People often ask if now is a good time to buy a home, but nobody ever asks whether or not it’s a good time to rent. Regardless, we want to make certain that everyone understands that with rental rates on the rise, now may not be a good time to rent.

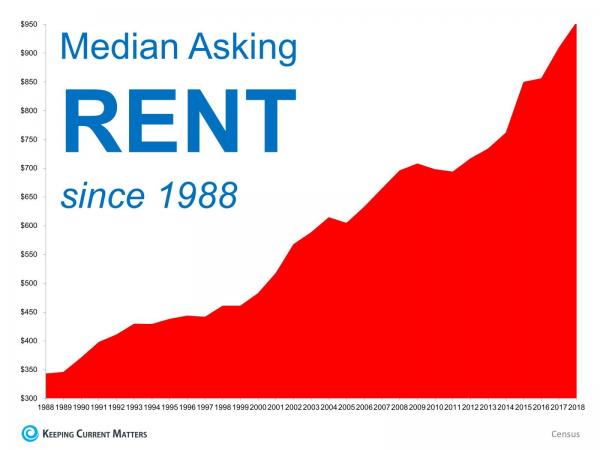

The Census Bureau recently released their 2018 first quarter median rent numbers. According to their report, here is a graph showing rent increases from 1988 until today:

As you can see, rents have steadily increased and are showing no signs of slowing down. If you are faced with making the decision of whether or not you should renew your lease, you might be pleasantly surprised at your ability to buy a home of your own instead.

Bottom Line

One way to protect yourself from rising rents is to lock in your housing expense by buying a home. If you are ready and willing to buy, meet with a local real estate professional who can help determine if you are able to today!

.jpg)

.jpg)

.jpg)