Mortgage Down Payment Gift Money for Home Buyers – The Perfect Holiday Gift

FHA Loan Gift Fund Guidelines

Who Can & Can’t Give FHA Gift Funds:

-

If you apply for an FHA loan, your gift funds must be from family or another eligible donor.

-

A close friend with a clearly defined and documented interest in the borrower.

-

The FHA allows gifts from your employer, a labor union or from charitable organizations.

-

You can use funds from government agencies or public entities that help low-to-moderate income or first-time home buyers.

-

Cousins, nieces, and nephews are not able to offer gift money under standard family guidelines.

What Can FHA Gift Funds Be Used For?

-

Gift funds can be used to cover things such as the down payment, FHA closing costs, or even the reserves needed for approval. In addition, if the gift is large enough, it could cover everything mentioned above.

-

Your down payment can come from gift funds if your credit score is above a certain amount. However, the down payment used for an FHA loan cannot come from another loan or source where the down payment needs to be repaid (i.e., another loan or credit card advance)

-

Finally, FHA Gift Funds can be used on primary residences only.

Conventional Loan Gift Fund Guidelines

Approved Sources of Conventional Loan Gift Funds:

- Fannie Mae & Freddie Mac define family as:

- Parent

- Children (including adopted, step and foster children)

- Sibling (including step-sibling, foster and adopted siblings)

- Grandparent (including great-grandparents, step and foster grandparents)

- Aunt and uncle (including great, step and foster aunt or uncle)

- Niece or nephew (including step-niece or nephew)

- Cousins (including adopted and step-cousins)

- In-laws (including parents and grandparents, aunt, uncle brother- and sister-in-law)

- Domestic partner

- Fiancé

What Can Conventional Loan Gift Funds Be Used For?

- Gift money can only be used on primary residence and second homes.

VA / USDA Loan Gift Fund Guidelines

Who Can & Can’t Give VA/USDA Loan Gift Funds:

- Must come from a family member.

- The gift cannot be from someone who is an interested party. An interested party would be someone who has a role in your transaction, such as a builder or developer, another broker, a real estate agent or the seller.

What Can VA/USDA Loan Gift Funds Be Used For?

- You can use gift money for your down payment with a VA/USDA Loan.

- Because they are 100% financing, there is no limit on the amount of the gift.

Can a Mortgage Gift be Repaid?

It’s called a gift for a reason, right? The answer is no. Therefore, the gift giver provides funds to a home buyer with no expectation of being repaid.

Will I Need to Provide a Gift Letter?

Yes, before you use the gift funds, you will need to submit a gift letter to your lender. This proves your relationship with the gift giver and that the funds are a gift and repayment is not expected. Some things to include inside your letter are:

- Dollar amount of gift

- Date funds were transferred

- Gift Giver’s signed statement that no repayment is expected

- Gift Giver’s name, address, and phone number along with the relationship to the borrower & buyer

- The address of the property being purchased

Check with your loan officer to see what information is required in your gift letter.

Keep in mind, gift funds in all cases will need to be documented. If you know you are about to receive a holiday infusion of cash, doing so by check is the easiest and often most convenient way to satisfy the lender.

Happy Holidays from Greenway Mortgage!

Is working from home becoming more permanent? Is your living room suddenly becoming your living office? Perhaps you’re running out of space? Whatever the reason, it’s more important than ever to have a functional and productive home office.

A recent Pew study showed that as of December 2020, an estimated 71% of Americans now work from home. Only 20% of working adults did so before the pandemic. In addition, a 2021 Houzz & Home Study showed that overall, home reno projects were up in 2020. Much of the work was focused on kitchens, home offices and outdoor spaces. These trends look likely to continue in 2021!

While working on the couch or at the kitchen table is an option, doing that long-term isn't productive or comfortable, especially if you have roommates, pets, or kids. It’s time to level up and consider repurposing an existing room or building a completely new area inside your home.

Cue the Home Renovation Loan.

We’ll go over our Renovation Loans and tips for funding your home office in just a moment. But first, let’s dive into what you can do to make a workplace that works for YOU so you can concentrate and do your best work in the comfort of your own home.

Ways To Make a Workplace That Works

1. Repurpose an Existing Room

First, look around your home. You’ll need to create a space that is conducive to your work style. Ask yourself the following questions:

-

Do you need more peace and quiet?

-

Do you need a separate room with fewer distractions?

-

Do you need a table with chairs for meetings?

-

Do you need a room with good lighting?

-

Do you need room for storage?

-

Do I have an extra room that can convert easily into an office?

You might be lucky enough to have a room you can convert into an office that checks off all your needs. However, if you do.jpg) n’t want to convert an entire room into an office, find a room in your home that has extra space to add a desk and some shelves. Have fun with it! Create your own special WTH nook.

n’t want to convert an entire room into an office, find a room in your home that has extra space to add a desk and some shelves. Have fun with it! Create your own special WTH nook.

2. Convert an Attic, Basement, or Garage

Do you have an unused attic or basement? Maybe you have a garage that’s collecting too much junk. Consider one of these areas in your home as an ideal spot for your new work office. You can even build half or full walls to divide the area if needed.

3. Build a Work from Home Office

A big undertaking, but something to consider if work from home is your new norm, is to add to your home. Consider building a new office or add a new master suite or great room and take an existing bedroom or part of a dining room and turn that into your new workspace.

If you decide to build a new home office, you’ll want to reach out to the pros. According to a NerdWallet report, homeowners hired professionals for about 63% of home improvement projects between 2017-2019. While there may be some things you can DIY, hiring a professional may be in your best interest especially for those bigger projects!

Tips For Funding Your Home Office

1. Use Your Savings

If you have money set aside to fund your home office this may be the best option for you. Keep in mind, you'll want to set a budget to avoid overspending. If you're tight on funds, a home renovation loan may be the next best option. Keep reading…

2. Home Renovation Loan

Tight on funds? You have options. Why not let your home pay for your new office. There are many home loans designed specifically for home renovations projects like this! In fact, our Home Renovation Loan Program is one of them.

What is a Home Renovation Loan?

Home Renovation Loans are the smartest way for homeowners to finance their entire renovation project. This type of loan gives homeowners the funds to make necessary or desirable renovations to a home or access to the credit to make those changes. In turn, these upgrades may enhance the livability and usability of the house and for sellers, plus they could increase the value of the home. Click to learn more about our Home Renovation Mortgage Programs.

What are some Renovation Loan Options?

There are several different types of home renovation loans. For instance, the FHA 203K Loan, Streamline 203K, the HomeStyle Renovation Loan and more. Click here to learn more about these loans to figure out which option is right for you based on your financial situation and home improvement needs.

2. Home Refinance

You can also consider refinancing. It's no myth, home values have been on the rise, creating more equity for homeowners. Equity is the difference between your home value and your home loan balance. A home refinance allows you to tap into your home’s equity so you can pay for home improvements.

A cash-out-refi is another great source of funds for creating your new office space. But what exactly is a Cash-out Refinance? This type of mortgage allows you to replace your existing mortgage with a new loan that draws on the equity in your home. The equity you draw with the new mortgage goes to you in cash. The cash can then be used for your home improvement project which in turn may increase your home's value.

How Much Can an Office Renovation Cost?

The cost of your home office depends on two things: whether you want to build a new home office or renovate an existing space into a home office.

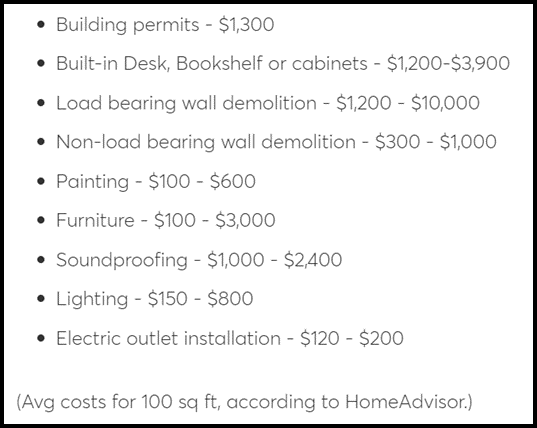

If you’re converting a bedroom to a home office, the average cost is around $3,500 according to Fixr. On the other hand, building an entirely new office space can be more costly. HomeAdvisor estimates that a home office renovation costs around $15,000, or roughly $100 per square foot, assuming that most home offices are around 100-200 square feet. This considers things such as:

Since costs vary depending on contractor, market, office size and project it’s generally a good idea to get quotes from 2-4 contractors.

Want to save even more money? Look on websites like eBay and Facebook Marketplace, where people are reselling office furniture in bulk at low prices to save you some money!

Don’t forget, If you’re self-employed, you can even use your home office space to qualify for a tax deduction (consult with your accountant).

Bottom Line:

Big project or small changes, renovation or refinance, speak with one of our loan experts about your loan options. Get started today and create a workspace that allows you to be productive while you’re at home. After all, you deserve it!

Greenway Mortgage is here to help every step of the way. We want to assure a smooth mortgage application and approval process so we put together a guide JUST FOR YOU.

Here's what you need to know:

Always provide ALL numbered pages of a bank statement

For example, while “Page 1 of 8” may be just a cover sheet, and “Page 8 of 8” may just be a blank page – an underwriter may not know that. Please include ALL pages of your bank statement to avoid confusion and delays.

Any deposit that’s not clearly identifiable as being from an employer can be subject to scrutiny

As a result, you may be asked to provide documentation to identify the source and purpose of these funds. Please have these ready!

Document your deposits

Get in the habit of making copies of all checks and deposit slips. Taking a picture on your phone is a great way to do this!

Be extra careful with cash

Don’t mix cash and checks together, in deposits or transactions. If you have to use cash, make sure you can document the source of the funds.

A transfer is treated the same way as a deposit

Whether its from your account or a gift from friends and family, its treated the same way as a deposit, and needs to be well documented.

Are You Ready to Push the Button? We’re ready to help. From Pre-approval, to comparative property analysis, through closing and beyond. That’s what we do every day, and we do it well. Reach out at your convenience, and let’s work together to achieve your homeownership goals.

What is a townhouse and is townhome living right for you? Today we’ll uncover everything you need to know.

Some may say that a townhouse is perfect for first-time home buyers and empty nesters as they provide the perfect alternative to owning a single-family home. If the idea of living in a townhouse has never crossed your mind before, you may not be familiar with what makes them so desirable.

What exactly is a townhouse?

A townhouse is an individually owned, multi-floor home that is attached to one or more units. The residents own and are responsible for the interior and exterior of their townhome. Townhouses look a lot like the traditional detached homes but tend to operate more like a condo. What does this mean? If you buy a townhouse, you might be part of a homeowner’s association. More on this later.

Townhouses are popular in dense urban and suburban areas and are known for their architectural style, consist of an attached home with shared walls, multiple stories, and sometimes have a front and back yard. Like condos, they share common spaces such as the pool. All in all, townhouses can be an affordable way for home buyers to get into a home in an expensive area.

Let’s take a look at some of the advantages and disadvantages of townhouse living to help give you a better idea if a townhouse fits your lifestyle.

What are some advantages to living in a townhouse?

Cheaper than Owning a Single-Family Home

Townhouses tend to be more affordable than single-family homes. And, if you’re considering buying a townhouse over renting, a townhouse has similar monthly costs. In addition, by owning a townhouse you will build equity.

Lower Maintenance

The great thing about townhouses is that sometimes there are front and backyards. And the best part is that most townhome HOA’s take care of landscape maintenance. So, if you’re not a fan of mowing the lawn, trimming shrubs, or pulling weeds you’re looking at the right type of real estate investment.

Location

Townhomes are certainly situated in convenient locations. You will not find yourself in the middle of nowhere. In fact, a townhome will put you near plenty of amenities such as shopping, dining and entertainment.

Sense of Community

Unlike owning a single-family home where you have a few neighbors spread apart, with townhome living your neighbors are must closer, making it feel more like a close-knit community!

Amenities

Did we mention convenience and amenities? Many of the services and amenities that you need will be included in the HOA fee or purchase price. What does this include? It includes things such as pest control, HVAC inspections, trash service, as well as amenities like swimming pools and gyms.

Freedom

Townhouses are similar to condos, but there is definitely one clear difference. If you own a condo you have ownership rights over the interior of the structure. When you buy a townhome, you usually own the exterior as well (check your HOA rules and regulations).

In addition, if you have a furry friend, we have good news. Your townhouse community may allow pets which is great because most come with a backyard! Make sure to check with the townhome association to see if pets are allowed.

What are some disadvantages to living in a townhouse?

Less Privacy

Townhouse living means sharing a wall with your neighbors on either side. This could ultimately be a deciding factor for your especially if you’re living next to someone who isn’t the most courteous neighbor. Keep in mind, your backyard will not be as private as if you were to own your own home.

More Responsibility

If you’re comparing townhouses to condos, townhouses come with more responsibility in terms of repairs and maintenance.

HOA Rules & Regulations

Take time to learn about the homeowner’s association. It’s important that before you decide to buy a townhouse you read up on the HOA rules and regulations and make sure to ask any important questions. Keep in mind, some townhouse communities have communal areas such as swimming pools and parking lots. These are probably controlled by the HOA. In addition, while you may have ownership of the exterior of your property, some HOAs will regulate the kinds of improvements you are allowed to make. Every townhouse community’s rules and regulations are different.

HOA Fees Can Get Expensive

Lots of times, people buy townhouses to save money. HOA dues can add additional costs. It’s important to make sure you take those into account before buying. In the end, if your HOA fees are higher then expected, you won’t be saving much. Fees can also change or increase over time.

Resale Value

Resale values on townhouses sometimes lag values of single-family homes in certain markets.

Bottom Line:

As you can see, there are many pros and cons to townhouse living. It truly depends on what your wants and needs are. Ask yourself, “What do I want out of homeownership?”

Some people like the idea of living in a smaller space that offers the freedom of owning a single-family home with the amenities of living in a condo, while others might have a strong preference for a detached home or condo.

We suggest shopping around to compare different townhouse communities. See what best fits your lifestyle. And, if townhouse living is calling your name, take the next step by giving us a call or click here to get your free pre-approval.

An appraisal is an important step in the home buying process. Basically, an appraisal is a professional evaluation of the market value of the home you’d like to purchase. Appraisals are ordered by the lender to confirm or verify the value of the home prior to lending a buyer money for the purchase. On the other hand, a home inspection is different from an appraisal. How so? Home inspections assess the condition of the home before the transaction is finalized.

Let’s take a closer look at the two and find out why a home appraisal and a home inspection is needed.

What is a Home Appraisal?

The National Association of Realtors (NAR) explains:

“A home purchase is typically the largest investment someone will make. Protect yourself by getting your investment appraised! An appraiser will observe the property, analyze the data, and report their findings to their client. For the typical home purchase transaction, the lender usually orders the appraisal to assist in the lender’s decision to provide funds for a mortgage.”

An appraisal is required by the lender. When you apply for a mortgage, an unbiased appraisal is the best way to confirm the value of the home based on the sales price. Regardless of what you’re willing to pay for a house, if you’ll be using a mortgage to fund your purchase, the appraisal will help make sure the bank doesn’t loan you more than what the home is worth.

In today’s sellers’ market having an appraisal is extremely important especially when low inventory is driving an increase in bidding wars which can increase home prices. When sellers are in a strong position like this, they tend to believe they can set whatever price they want for their house under the assumption that competing buyers will be willing to pay more.

Lenders will only allow the buyer to borrow based on the value of the home. All in all, this is what helps keep home prices fair. If there’s every any discrepancy between the appraisal and the sale price of the home, your Real Estate Agent can help you navigate any additional negotiations.

What is a Home Inspection?

Here’s the key difference between an appraisal and an inspection. MSN explains:

“In simplest terms, a home appraisal determines the value of a home, while a home inspection determines the condition of a home.”

With a home inspection, one can determine the current state, safety, and condition of the home before the sale is made. If anything is questionable in the inspection process – like the age of the roof, the state of the HVAC system, or just about anything else – you as a buyer have the option to discuss and negotiate any potential issues or repairs with the seller before the transaction is final. Your Real Estate Agent can help you through this part of the process as well.

In a recent blog on 'What Should You Expect From a Home Inspection', find out how to choose an inspector, what you should expect during the inspection and learn about the things the inspector will review.

Bottom Line

The appraisal and the inspection are critical steps when buying a home, and you don’t need to manage them by yourself.

Have questions? Reach out to us today and we’ll give you the expert guidance you deserve to navigate through the entire home buying process.

.png)

.png)

.png)