The Annual Percentage Rate (APR) is not the rate you pay. Homebuyers will often believe the lowest annual percentage rate (APR) is the best.

In fact, it's more important for buyers to weigh options against their personal financial situation and the amount of time they plan to have the loan.

Low APRs typically come with the highest cost, and those funds can often be better deployed against larger down payments or, in some instances, paying off high-rate consumer debt.

Here's a quick overview of what an APR is and how to calculate the costs and/or savings that accompany a lower one.(1).png)

What is APR?

APR is not the interest rate that you pay. It’s a government-required calculation intended to show the total cost of borrowing, expressed as an interest rate.

The APR is derived from a formula using these two factors:

- The actual rate and term of your loan

- Certain closing costs that are associated with your loan

Again, it is not the rate you actually pay. Click here to see how APR actually works.

APR is best used as a tool for comparing loans with dissimilar terms. Where APR is lower, associated costs of closing your loan may actually be higher. Keep in mind that the calculation assumes you'll keep your loan for its full term. Few people ever see the 5th year of their home loans these days, much less the 30th.

APR will be lower on a loan where you pay more “points” to lower the interest rate. But if you don’t hold the loan long enough to earn back the points paid up front, that money will be wasted. If APR were calculated for the average amount of time borrowers actually have their loans instead of the full term, it would be higher. Comparisons would be more helpful and less potentially misleading.

Bottom Line:

APR is intended to give you more information about what you're really paying.

Any time you or someone you know has questions about interest rates or any aspect of home financing, please reach out.

The Greenway Team is happy to help! Reach out to us today.

|

|

|

|

|

|

MarketMinute | How did Fed action impact mortgage rates?

|

|

|

|

|

|

Is the home you want out of reach?

In a time of rising rates and prices, the home you really want may be out of reach with the typical fixed-rate loan.

But stretching further isn't really much of a stretch at all with an ARM—an adjustable rate mortgage. If you're skeptical, be assured they've changed for the better over the years.

Here's How Adjustable Rate Mortgages Work:

-

Most ARMs are hybrid. They are fixed for a period of time, usually 5, 7 or 10 years, before being subject to adjustments.

-

During the initial period, rates (and monthly payments) will typically be lower than those offered by fixed-rate loans.

-

Interest rate caps can keep future adjustments predictable.

For example, a 30-year loan of $300,000 could have a payment savings of over $183 per month with an interest rate that's 1% lower. A loan such as a 5/1 ARM may offer this kind of payment savings.

Is An ARM Right For You?

ARMs aren't for everyone, but hybrid ARM loans can offer years of fixed principal and interest payments. They work especially well if you plan to sell or refinance before the adjustments occur.

Click below to estimate the payment and savings a hybrid ARM can offer, as well as income required to qualify.

If higher rates and prices are keeping you from the home you really want, it is worth a look to see the difference an ARM loan may provide.

Please reach out, and we'll be happy to help.

4 Biggest Real Estate And Mortgage Questions

It’s no secret the real estate market is in a constant state of shifts and changes. In uncertain times like these, naturally, questions will arise regarding rising rates, the housing market, and if we’re headed towards a recession.

Lately, there has been four big questions coming up that we’d like to help answer to ease any uncertainty, especially for those looking to purchase a home this year.

Let’s take a deeper look.

#1: What’s Happening with Mortgage Rates?

Rising mortgage rates are no doubt one of the biggest factors impacting the housing market right now. It is important to remember that the low rates of the last few years were an anomaly.

As inflation rises and mortgage rates climb, many may see their purchasing power shrink and their dream of homeownership fade.

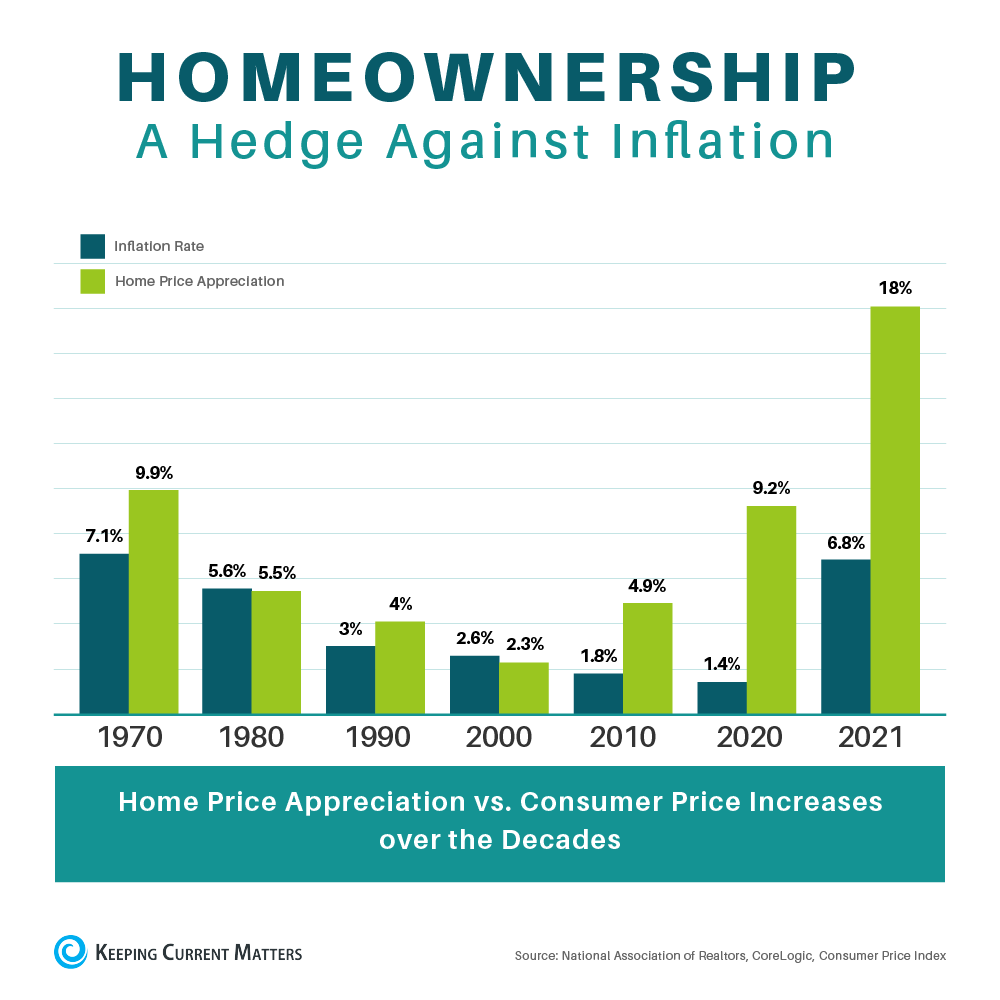

One big piece of economic wisdom: there is no better hedge against inflation than homeownership.

Historically, we have seen homeownership outperform inflation in most decades. So, if there’s an asset to invest in, housing is one of the few tangible assets that tends to hold its value.

We can’t control what’s going to happen with mortgage rates or price appreciation, but we can control what we prioritize. That way, in times of uncertainty, you see these factors less as stop signs and more as opportunities for growth and change.

#2: What Will Happen to Real Estate If There’s a Recession?

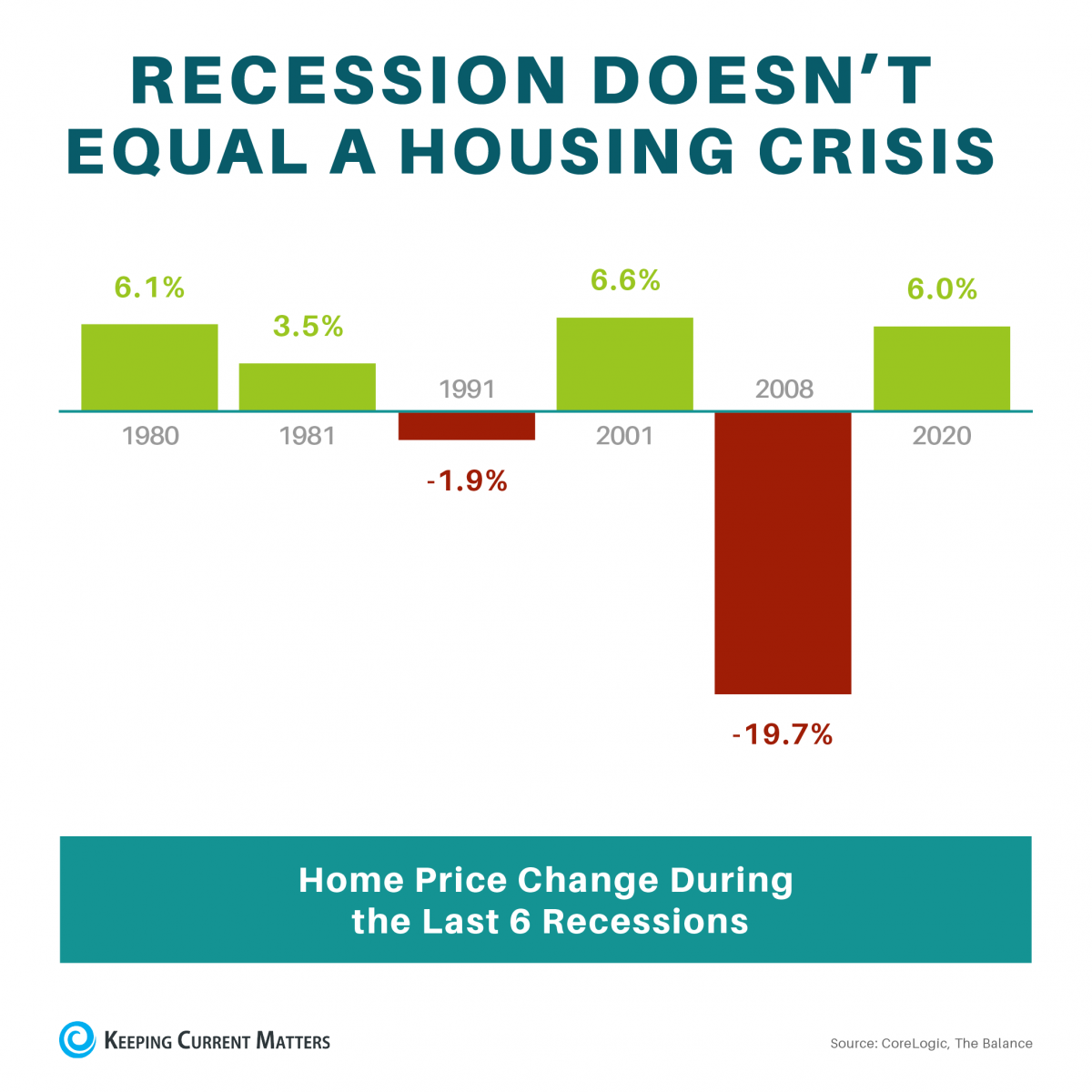

Post-2008, nothing will strike fear into the hearts of buyers and sellers like the word “recession.” But historical context is everything and this chart can give some serious perspective.

Home prices have continued to appreciate in 4 out of the last 6 recessions. If a recession happens, it does not necessarily mean home prices will decline. Rates usually rise at the beginning of an economic decline, but to stimulate the economy, they typically fall.

According to Fortune,

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

Now is a great time to reach out to see what home buying options are best for YOU.

#3: What’s Going to Happen This Year in Real Estate?

When we’re constantly being bombarded with different opinions and information, it’s easy to get lost in the noise.

While signs of a market shift become clearer each day, it’s important to remember that context is everything. Yes, we are seeing a slowdown. However, we are just heading back toward the marketplace we saw pre-pandemic, and those were still great years for real estate.

Focus on the big picture, and that’s this: the housing market is still very strong, and previous projections are already outperforming what industry experts forecasted earlier this year.

Yes, now is still the time to buy. We should start to see less competition, fewer bidding wars, and, therefore, less upward price pressure.

In fact, a simple analysis shows that a one-month increase in the months’ supply results in a 3% decline in annualized house price growth. And our preliminary house price index is already showing moderation in house prices in April.” —Mark Fleming, Chief Economist, First American

#4: Should I Buy a Home Right Now?

This is by far the most asked question of all. The short answer is Yes. However, the right time to buy is when YOU’RE ready.

.png)

Trying to time the housing market for that deal of a lifetime is like trying to win the lottery. And while purchasing a home today may not be as easy as it was a couple of years ago, the latest data shows that inventory levels are rising, which means more moderate price appreciation and more options for buyers.

Being prepared in this competitive real estate market is key. So, if you’re looking to buy soon, this is a great time to prepare for when the right home comes along. Here are a few tips:

- Having the right Loan Officer (we know a few 😉) and Real Estate Agent on your side is key to helping you navigate through the process.

- Get an upfront pre-approval. A pre-approval will help you better understand your budget and it helps your agent find that dream home. Plus, it’ll help you beat out the competition!

- To prepare for pre-approval gather the following docs: proof of income/assets, employment verification, credit history, ID, SS#.

- If you’re in search of a local Real Estate agent in your area reach out and we’ll connect you with some of our favorites. Contact us here or give us a call at (908) 489-4658.

Bottom Line:

Don’t let the headlines turn you away from your dream of homeownership. No one can control what’s going to happen with mortgage rates or price appreciation. Home prices could come down this year, inventory may open up and mortgage rates might start to drop.

Whether it’s a good time to buy a home or not depends on your personal financial picture. You’re in a strong position to buy a home if you have a steady job, a down payment saved up, a good credit score, and low levels of debt. If you’re not in an ideal to buy now take the time to prepare. Learn how to budget, save for a down payment and work on your credit.

Greenway Mortgage offers a wide variety of home loans. We have something for everyone. Give us a call and we’ll discuss which option is best for you!

Helpful Resources:

Visit us online for more information regarding loan programs and helpful resources to get you started!

.png)

.jpg)

.png)