3 Biggest Questions About Real Estate and Mortgages

As we near the end of 2022, the housing market is still in a constant state of shifts and changes. Some bigger or more impactful than others, but the truth remains the same: while we wish we had a crystal ball, we’ll never be able to predict what’s going to happen. However, one thing will always remain constant: people will always need a place to call home.

There are three big questions in real estate and in the mortgage industry right now. We’ll cover them here. So, before you hit the panic button, give this a read!

Will Mortgage Rates Continue to Rise?

To answer this question, it’s important to understand the why behind the reason mortgage rates have doubled since the beginning of the year and that’s due to inflation.

To ease inflation, the Federal Reserve is taking steps to tame inflation by slowing the economy. In turn, these decisions have an impact on mortgage rates. Until this is under control, we may continue to see rates stay high or rise even higher.

Despite the high mortgage rates, there is still opportunity in the real estate market.

“There is no doubt that the increasing mortgage rate will make homebuying even more challenging, . . . buyers may still find opportunities, as these changes coincide with the time of the year when buyers have historically found the best market conditions to obtain more bargaining power,” said Jiayi Xiu, economist for realtor.com.

What Will Happen to Home Prices?

Dave Ramsey sums it up: “The root issue of what drives house prices almost always is supply and demand.”

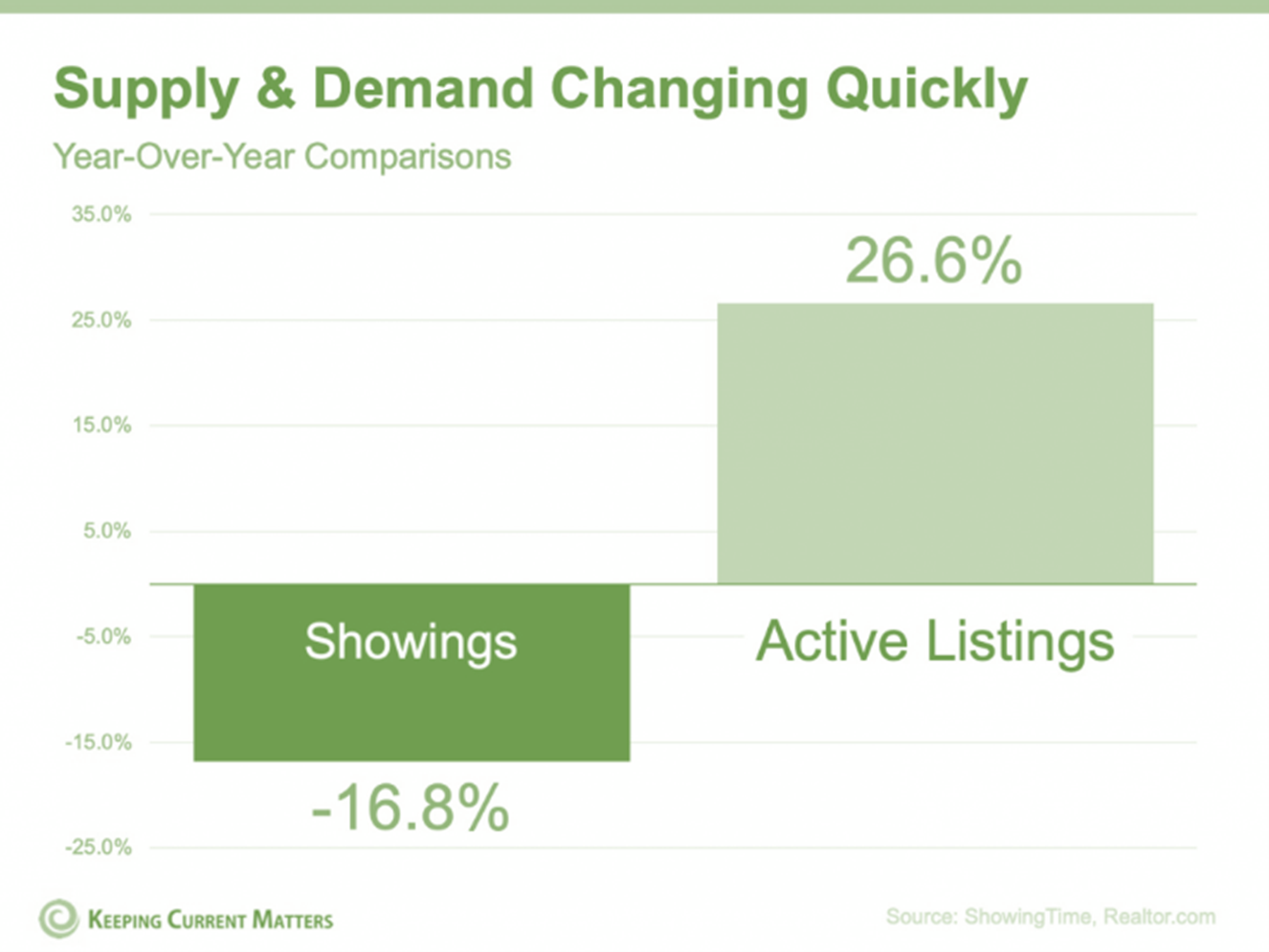

And when you look at the graph below, you’ll see why we have seen such a large slowdown in home price appreciation in the last few months.

The sudden uptick in mortgage rates and lingering inflation has changed the playing field in the housing market. So, as the pace of sales slows, the more active listings there are. That does not mean we’ll see national deprecation in home values.

Overall, experts are projecting continued price appreciation in most markets, averaging about 1.8% in 2023. However, there are some overheated areas where experts are projecting slight depreciation, but certainly not enough to call it a crash.

Should I Buy A Home Right Now?

Homeownership has many financial and non-financial benefits. It’s true that it costs more to buy a home today than it did last year, but the same is also true for renting. This means, either way, you’re going to be paying more.

Although affordability is challenging right now, buying a home helps you gain equity will will help grow your net worth.

The best way to answer this question is that homeownership will always win over time. It’s a long game.

You can choose to put your money over time into rent and not get a return or play the long game, invest in homeownership and benefit from your investment.

Bottom Line:

As we said before, we wish we had a crystal ball to predict what’s going to happen with mortgage rates or price appreciation, but we unfortunately can’t control that.

Remember, the team at Greenway Mortgage is always here to help answer any questions you have. We are happy to sit down with you to discus which home buying option best suites your scenario and find out how much home you can afford. We’re here to help.

.png)