Fannie Mae Is Making It Easier For Millennials To Buy Their First Home

Fannie Mae is making it a little easier for people with all kinds of existing debt — including student loans — to qualify for mortgages.

What is DTI?

DTI or Debt-to-Income is a borrower’s total amount of debt, including credit cards, student loans, auto loans and mortgages, versus their total income.

Previously, a borrower's DTI was set to a max of 44% but come July 29, Fannie Mae will be raising its DTI ceiling to 50 percent.

Using data spanning nearly a decade and a half, Fannie’s researchers analyzed borrowers with DTIs in the 45 percent to 50 percent range and found that a significant number of them actually have good credit and are not prone to default.

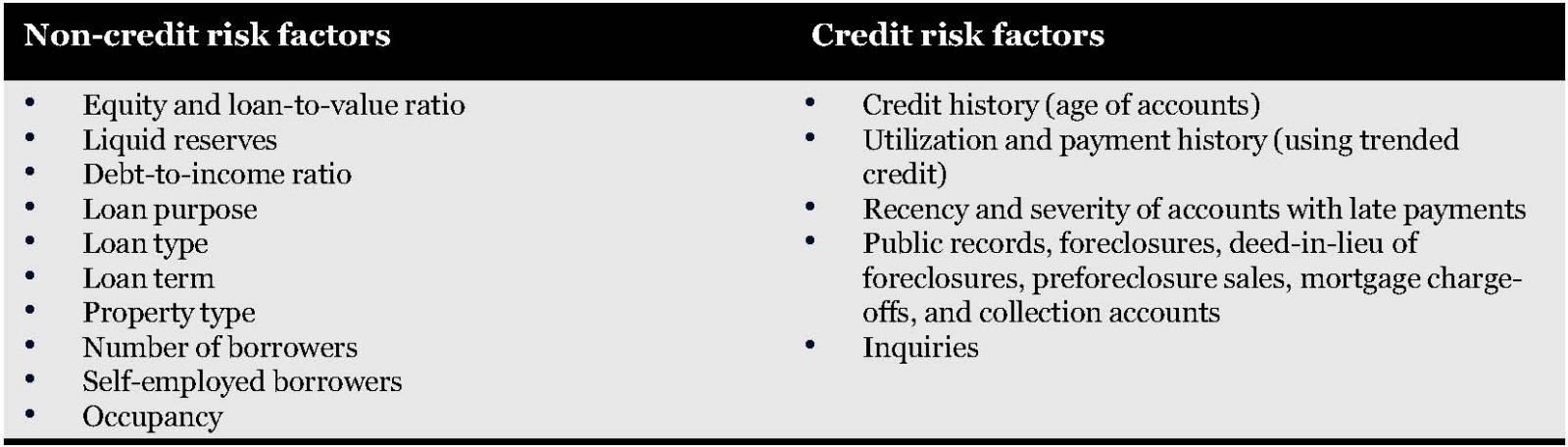

Here's a chart to give you an idea of the kinds of risk factors that are taken into consideration when your FICO score is pulled.

The Takeaway

The ease in DTI requirements is great for Millennials worried about student loan debt affecting their creditworthiness and eligibility to qualify for a mortgage. If they are stressed about making the down-payment, there are plenty of low-down-payment programs available from Greenway that can help them get started.