Understanding Rate Locks: Why Longer Locks Come with Higher Costs

When you apply for a mortgage, one of the most crucial decisions you'll face is locking in your interest rate. But why do longer rate locks tend to cost more? It all comes down to risk—both for you and the lender.

The Role of Interest Rate Fluctuations

Between the time you apply for a loan and the moment you close, interest rates will fluctuate. Sometimes, these changes are subtle, but they can also be quite volatile, even shifting from one minute to the next. Locking in your rate serves as a safeguard against rising rates, much like purchasing an insurance policy.

The Lender's Perspective: Risk Management

When you lock in your rate, you're effectively transferring the risk of rising rates to the lender. To manage this risk, lenders often purchase financial instruments called "hedges," such as U.S. Treasury Bonds, which move inversely to interest rates. However, these hedges come at a cost. The longer the lock period, the more expensive the hedge, which is reflected in the cost of your loan.

How Loan Type Influences Rate Lock Costs

The type of loan you're considering can also influence the cost of a rate lock. Some loans, like adjustable-rate mortgages (ARMs), are tied to indexes that move more slowly compared to the daily fluctuations in the broader market. This reduced volatility can result in lower costs for longer rate locks.

Making the Right Decision for You

Predicting interest rate movements is nearly impossible, which is why choosing the right rate lock duration often comes down to personal comfort. If the thought of fluctuating rates makes you uneasy, opting for a longer lock—even at a higher cost—might be worth the peace of mind. On the other hand, if you're comfortable with a bit of risk, a shorter lock could potentially save you money.

Whatever your choice, we're here to guide you through the process and ensure you feel confident every step of the way.

Did you know that investment funds may be hiding in your mortgage? It's true! You may have more to invest than you think.

A mortgage is the single largest liability most people ever assume. Do your realize its proper management is as important as for any investment?

30-Year vs 15-Year Loan

Which is best the best option? A 30-year or a 15-year loan? Many homeowners want to pay their home loan off as soon as possible, but the value of putting their money into long-term savings and investments often trumps a rapid amortization of principal.

Why pay down the balance on a home loan, only to borrow again later to pay for the kids' college?

The differential savings of a 30-year loan vs. a 15-year option can be put in a 529 plan instead. The result is tax-advantaged growth over time and no uncertainty of borrowing at a potentially high rate later.

Have questions or want to learn more. Reach out! The Greenway Team would love to help and answer any questions you may have.

When interest rates were at historic lows, a typical fixed rate mortgage loan was all most people needed. Now, rates have risen. They’re still below long-term averages, yet appreciably higher than before. And of course, higher interest rates lead to higher monthly payments.

Here at Greenway Mortgage, we recognize the rising rate environment and how homeownership may feel out of reach for some. That’s why we now offer a 2-1 Buydown Program to help counteract the trend towards higher rates.

It’s what everyone’s talking about these days, a 2-1 Buydown. We’re sure you’ve probably heard of it, but you may not know exactly what it means. That’s where we come in.

What is a 2-1 Buydown Loan?

With a 2/1 Buydown, borrowers get a 30-year fixed rate loan with an interest rate that’s temporarily discounted 2% during the first year and 1% the second year by paying an upfront fee at closing. By the third year of the mortgage term, the interest rate reaches the original interest rate on the loan.

Borrowers can ease their way into a home with lower payments that simply step up at the end of the first and second year then remain fixed for the remainder of the loan. Here are the details:

Program Details:

- 1st Year: Interest rate starts at 2% under the locked rate

- 2nd Year: Interest rate is 1% below the locked rate.

- 3rd Year: Loan converts to the locked interest rate.

The Fine Print

- Borrower must qualify for full monthly payment (before buydown rate is applied).

- Third-party contributions are eligible.

- Eligibility requirements, exclusions and other terms and conditions apply.

Example of a 2-1 Buydown

Say you lock in a 5% interest rate, the 2-1 Buydown Program allows you to make monthly payments at a 3% interest rate for the entire first year of your mortgage.

Then, in year two, your payments would be based on a 4% interest rate.

Finally, once you hit year three and for the remaining life of your loan, your payments would reflect your originally-agreed-upon 5% interest rate.

What Types of Loans is a 2-1 Buydown Available For?

2-1 Buydowns are available on conforming fixed products.

- 30-year Fixed Rate Conforming Loans*

- Conventional Purchases | Primary: 1-4 Units, Second Home: 1 Unit

- Conventional Refis | Limited Cash-out

- HomeReady / HomePossible | Purchase Primary: 1 Unit

- FHA, VA, USDA | Purchase Primary: 1-4 Units

- FHA 2nd Home | 1 Unit

*High Balance available Conventional, HomeReady, HomePossible

Who Can Benefit From a 2-1 Buydown?

- Borrowers who may earn more within a few years of obtaining mortgage.

- Borrowers who want to use the savings to reduce bills/debt.

- Borrowers receiving contribution or gifts that will fund the buydown at closing.

How Can a Borrower Benefit from a Temporary Buydown?

- Borrowers will pay less money upfront on their monthly mortgage payments.

- It helps ease borrowers into making monthly payments and it saves you money during the first two years of homeownership.

- Lessens the burned on your wallet with any extra expenses typically associated with moving into a new house (furniture, paint, new appliances, etc.)

Why are we seeing the 2-1 Buydown Program now?

In an environment where interest rates are rising, the 2-1 buydown benefits home buyers by helping them ease into the full monthly payment. It’s especially appealing for first-time homebuyers who are having a hard time purchasing a home in a housing market like we’re seeing today.

Bottom Line

If you’re currently house hunting in this turbulent housing market and need to find solutions to lower your monthly payments, this is a program is worth exploring. The market is shifting, but while it’s influenced by high interest rates and high home prices, borrowers may benefit from a 2-1 buydown.

So, are you interested in purchasing a new home and like the idea of easing into your mortgage payments? Contact the team at Greenway Mortgage to get started.

When you were younger, your home was the perfect place. Your spacious backyard provided a place for your children and even your pets to run and play. Your kitchen provided meals to feed your family and your living room and den served as the family gathering spot. During those years, the last thing you may have thought was leaving the home that you loved and made so many memories in.

However, as you enter the stage of retirement you may begin to realize you prefer to grow older in a new home that best fits this new stage in your life. For instance, your current home may be too large for your needs and having a multiple-level home with many rooms may take more work to maintain than you want.

Whatever your reasons may be, downsizing to a smaller, more manageable home is ideal.

Just think, you could purchase your new dream home with no monthly mortgage payments* with the Home Equity Conversion Mortgage (HECM).

Commonly known as a “reverse mortgage”, the Home Equity Conversion Mortgage (HECM) is a government-insured loan that allows older homeowners to convert home-equity into tax-free cash.* Perfect for borrowers who are downsizing or want to purchase a home without a monthly mortgage payment.*

PROGRAM DETAILS:

- No payment option available*

- HECMs are federally insured.

- Same products, limits, LTVs, and rates as traditional mortgages

- Excellent planning tool to fund retirement

THE FINE PRINT

- Must be 62 years old, or older

- Applies only to owner-occupied, primary residences

- Mandatory HUD counseling

- The homeowner is still responsible for property taxes, homeowners insurance, upkeep and any relevant HOA fees.

*Age-based assessment and other guidelines determine allowable equity ratios. Various payment and draw options available.

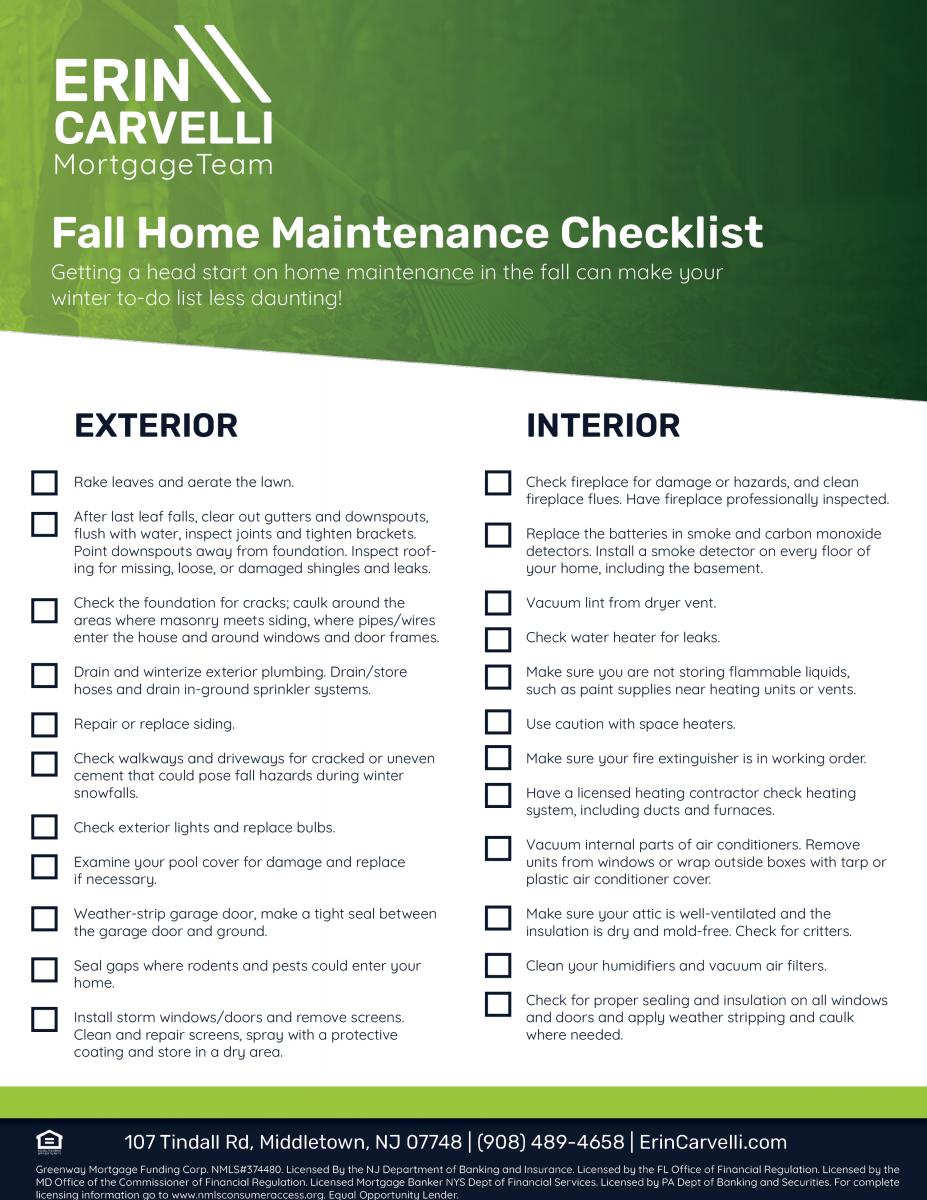

It would be amazing if all you needed to prep your home for fall was hang a wreath and light a bunch of pumpkin spice candles. While yes, those are a part of getting ready for the change of seasons, there are more important preparations that come with being a homeowner.

With that said, fall is the perfect season to tackle general home maintenance projects because the weather is generally dry and temperatures are moderate. Before you start your seasonal home maintenance checklist, examine both the interior and exterior of your home.

Most of these home maintenance items can be accomplished without the help of a professional, but it's always better to be safe and call for assistance if a home improvement project is beyond your abilities.

Tick these items off your list this season, and you can rest easy knowing that your home and yard are buttoned up and ready for winter. Happy Fall from your friends at Greenway Mortgage!

.png)

.png)

.png)