The mortgage process can be intimidating. During the early stages of qualification, we have to ask many questions that may not seem to relate to a mortgage, and we request a lot of documentation. This is necessary because guidelines have become more stringent to ensure borrowers don’t bite off more than they can chew.

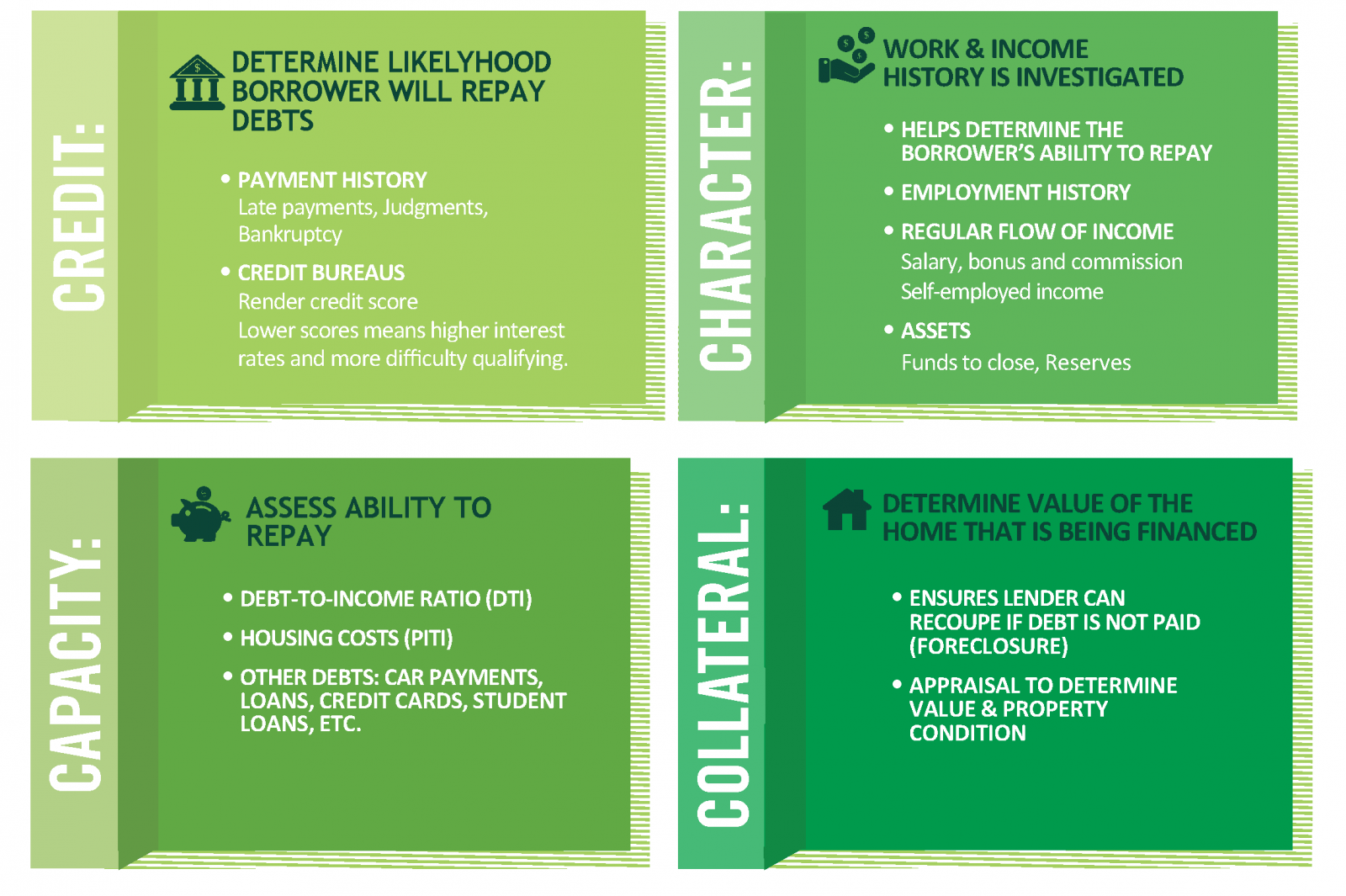

Understanding the underwriting process can help ease stress and streamline the effort. In general, mortgage lenders like Emerald Home Loans observe the 4 Cs of borrower qualification – Character, Credit, Capacity and Collateral. Since every individual’s financial situation varies, this method helps Emerald Home Loans determine if a particular borrower and property are mortgage worthy.

Did you miss last week's blog? Click here to read it today: Organize Your Finances