How First-Time Home Buyers Can Get Help With Closing Costs from Sellers

What are Seller Concessions?

Seller concessions, sometimes referred to as Interested Party Contributions (IPC) or ‘Seller Assist’, are when a home buyer (you) asks the home seller (not you) to pay some or all of the costs on the home buyer’s behalf. These costs could include:

-

Homeowner's insurance

-

Property taxes due at closing

-

Escrow account set up

-

Pre-paid interest

-

Attorney/settlement agent fees

The purchaser may request seller concessions during contract negotiations, or the seller may offer a concession during the listing process.

How Do Seller Concessions Work?

Let’s say that the agreed sales price between a buyer and a seller is $200,000. The buyer needs an additional $7000 to cover their closing costs and prepaids such as: taxes, insurance, and escrows.

The buyer then asks the seller for a credit of $7000 to be given at closing. The sale price of the house then increases to $207,000. The buyer receives the credit of $7000 at the time of closing and the seller still nets the agreed upon price of $200,000.

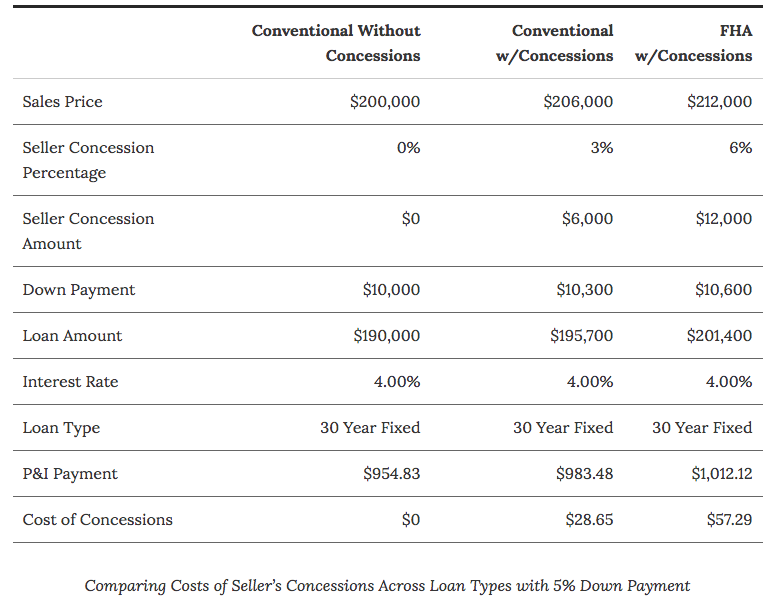

However, there are stipulations: 1) the home must appraise for a sale price of $207,000 and 2) the buyer must pay an increased down-payment based on the increased sales price, e.g., conventional 5% down on $200,000 is only $10,000 while 5% on $207,000 is $10,350.

But understand, the seller isn’t really paying your closing costs – you are mortgaging them.

Seller concessions are allowed on all major loan types, including conventional loans backed by Fannie Mae and Freddie Mac; FHA loans backed by the Federal Housing Administration; VA loans backed by the Department of Veterans Affairs; and, USDA loans backed the U.S. Department of Agriculture.

However, there are limits. You cannot request unlimited seller concessions. Depending on the buyer's loan type, seller concessions are capped to a specific percentage of the loan size. For instance:

-

FHA = 6% of sales price

-

A conventional loan = 3% seller concessions for loans with LTVs greater than 90%, 6% for loan LTVs between 75-90% (owner occupied/2nd home)

-

Investment properties are capped to 2% of the purchase price.

How do Seller Concessions Benefit the Buyer?

For the buyer, being able to finance closing costs into the mortgage allows them to place a larger down payment which in turn saves them money on their monthly mortgage payment.

For those with limited funds, the number of properties available increases.

Why Would A Seller Agree to Concessions?

In a competitive buyers’ market, a house with a seller concession can be more attractive to a buyer. If a homeowner needs to sell quickly, seller concessions can help to expand the pool of qualified borrowers able to purchase the property.

Next Steps

If you're looking to buy and don't want to pay closing costs, seller concessions are a good way to reduce the amount you'll need at your settlement. If you are uncertain whether your desired seller concessions fall within your loan guidelines, then check with your Greenway Mortgage professional to plan for those steps.

Contact us at (732) 626-9827 or at smt.greenwaymortgage.com/contact