First-Time Home Buyers: Getting Your House In Order

For first time homebuyers, one of the most important steps towards home ownership may not be as fun as wandering through various open houses, but it is no less essential. Before you’re ready to make a serious offer on the property of your choice – or even start your real estate search in earnest – you need to know how much you can afford. In other words, before you can sign the papers on that new house, you need to focus on getting your financial “house” in order.

At Greenway, we help our clients with this every day... it’s called getting pre-approved. Trust Greenway to help guide you through the process of gathering and reviewing your financial information. Your loan officer will ask you a series of questions about your income such as salary, overtime and bonuses.

We will also ask about debts such as student loans, credit cards and car payments as well as any savings accounts you have. Because calculating your “qualified” income isn’t exactly straightforward, we ask for bank statements, W2s and pay stubs. Using this information, our mortgage professionals will calculate your net income, debt to income ratio and help identify a mortgage and down payment amount that fits your profile.

Greenway’s loan officers are well-versed in working with first-time home buyers and will help identify the right mortgage product for your specific financial situation. And, if necessary, we will help you get your finances in order and work with you on improving your credit

score.

As a first-time homebuyer, it’s also important to remember that your credit score and credit history are key to being approved for a loan – and getting a good rate. In talking with your Greenway loan consultant, you’ll want to discuss any credit problems up front so we can address and correct where possible. Getting pre-qualified at Greenway is free and takes only a few minutes to get the ball rolling. Give us a call (908) 489-4658 or get pre-approved in less than 5 minutes now.

The mortgage process can be intimidating. During the early stages of qualification, we have to ask many questions that may not seem to relate to a mortgage, and we request a lot of documentation. This is necessary because guidelines have become more stringent to ensure borrowers don’t bite off more than they can chew.

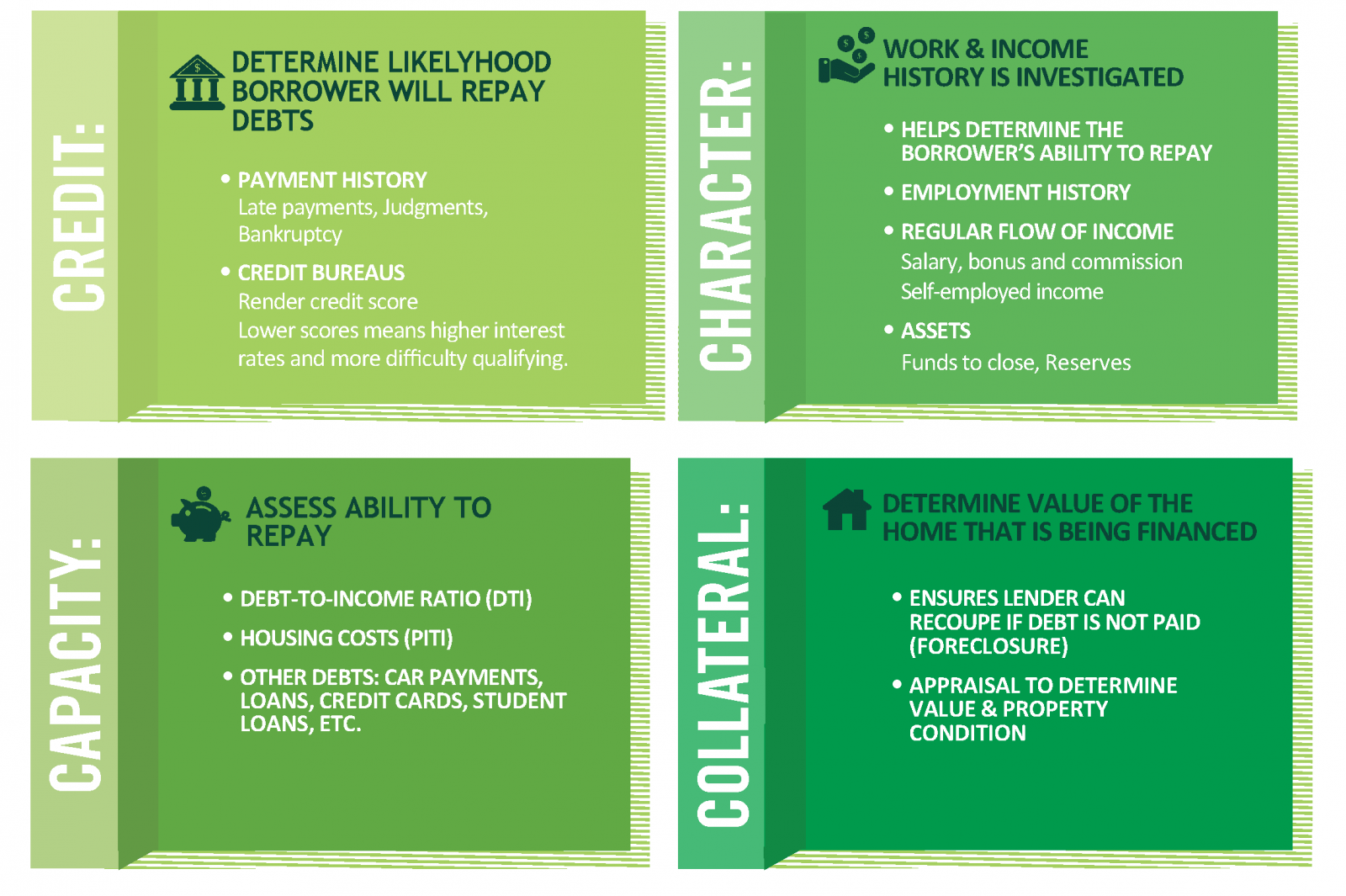

Understanding the underwriting process can help ease stress and streamline the effort. In general, mortgage lenders like Emerald Home Loans observe the 4 Cs of borrower qualification – Character, Credit, Capacity and Collateral. Since every individual’s financial situation varies, this method helps Emerald Home Loans determine if a particular borrower and property are mortgage worthy.

Did you miss last week's blog? Click here to read it today: Organize Your Finances

Monmouth County, NJ First-Time Home Buyer Assistance Program Can Help!

The Monmouth County, NJ First Time Homebuyer Assistance Program is designed to provide financial assistance to low income families to purchase an affordable home in the form of a deferred payment second mortgage loan in an amount not to exceed $10,000 for down payment and closing costs (only).

PROGRAM DETAILS & ELIGIBILITY

-

MUST BE a resident of Monmouth County for 1 YEAR before applying for a grant.

-

ALL applicants must complete a pre-purchase housing counseling course and provide a certificate of completion with the First-Time Homebuyer application.

-

MUST BE an individual(s) that never owned a home (except if an applicant has previously owned a home he/she still may qualify if they meet 1 or more of the following criteria:

-

An individual that has not owned a home in 3 years prior to receiving home assistance.

-

An individual who is a single parent even if the individual owned a home with his or her spouse or resided in a home owned by the spouse

-

An individual who is a displaced homemaker even if as a homemaker the individual owned a home with his or her spouse or resided in a home owned by the spouse.

-

Must be low income. Gross annual income does not exceed 80% of the county median income:

-

(2).jpg)

FINE PRINT:

-

Property MUST be the principal residence

-

Applicant must purchase a house located in the participating municipalities ONLY.

-

Fist-time homebuyer can only purchase a 1-4 family property or condominium unit.

-

Housing unit cannot exceed the max purchase price of $337,000 for 1-family & condominium, $432,000 for 2-family unit, $532,000 for a 3-family unit and $648,000 for a 4-family unit.

-

Mobile homes are not eligible for purchase using First-time Homebuyer program funds

-

Co-signor not allowed

Still have questions about the FIRST-TIME HOMEBUYER ASSISTANCE PROGRAM? Contact us today!

Monmouth County, NJ First-Time Home Buyer Assistance Program Can Help!

The Monmouth County, NJ First Time Homebuyer Assistance Program is designed to provide financial assistance to low income families to purchase an affordable home in the form of a deferred payment second mortgage loan in an amount not to exceed $10,000 for down payment and closing costs (only).

PROGRAM DETAILS & ELIGIBILITY

-

MUST BE a resident of Monmouth County for 1 YEAR before applying for a grant.

-

ALL applicants must complete a pre-purchase housing counseling course and provide a certificate of completion with the First-Time Homebuyer application.

-

MUST BE an individual(s) that never owned a home (except if an applicant has previously owned a home he/she still may qualify if they meet 1 or more of the following criteria:

-

An individual that has not owned a home in 3 years prior to receiving home assistance.

-

An individual who is a single parent even if the individual owned a home with his or her spouse or resided in a home owned by the spouse

-

An individual who is a displaced homemaker even if as a homemaker the individual owned a home with his or her spouse or resided in a home owned by the spouse.

-

Must be low income. Gross annual income does not exceed 80% of the county median income:

-

(1).jpg)

FINE PRINT:

-

Property MUST be the principal residence

-

Applicant must purchase a house located in the participating municipalities ONLY.

-

Fist-time homebuyer can only purchase a 1-4 family property or condominium unit.

-

Housing unit cannot exceed the max purchase price of $337,000 for 1-family & condominium, $432,000 for 2-family unit, $532,000 for a 3-family unit and $648,000 for a 4-family unit.

-

Mobile homes are not eligible for purchase using First-time Homebuyer program funds

-

Co-signor not allowed

Still have questions about the FIRST-TIME HOMEBUYER ASSISTANCE PROGRAM? Contact us today!

Getting preapproved for a mortgage before you go home shopping isn’t required, but it is a good idea. Unlike a pre-qualification, a preapproval letter lends weight to your bid on a home, proving to sellers that you have the financial clout to stand behind your offer. When you're ready to get preapproved it's important to know what you'll need in terms of documentation. It's likely you already have many of the records you’ll need or easy access to them. Take a look at the list below.

ORGANIZE YOUR FINANCES

In order to get you pre-approved we need the documentation below. All of this and more will be needed once your loan is in process so might as well pull it together now.

- Pay stubs – last 30 days

- W2s – last 2 years

- Federal tax returns – last 2 years, all pages and schedules

- Bank statements – Last 2 months, all pages

- Realtor and attorney contact info

- Copy of photo ID – must be legible

Did you miss last week's blog? Learn more about Mortgage Basics here.

.jpg)