3 Tips for Single Home Buyers: How to Make Your Dream of Homeownership A Reality

The thought of buying a home on your own as a single home buyer can be intimidating. If you’re making this leap, it’s going to take careful planning and the right team of experts.

Research from Freddie Mac shows 28% of all households (36.1 million) are sole-person, and that number is growing. Over the past 40 years, the number of sole-person households has nearly doubled, and that’s a trend that’s expected to continue as more and more Americans choose to live alone.

“Our calculation suggests that there will be an additional 5 million sole-person households in the United States by the next decade. This means 42% of the household growth will be contributed by sole-person households, . . .”

Do you fall into this category? Here are three tips to help you achieve your homeownership goals.

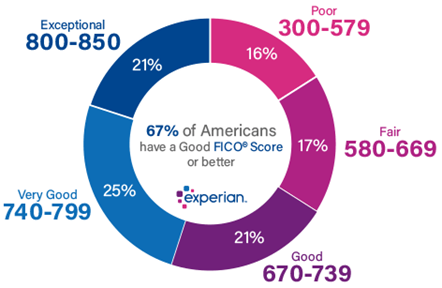

#1 Know Your Credit Score

When you buy a home on your own, you must qualify for your loan based entirely on your finances and credit history. Mortgage lenders will look at your credit profile only so it’s a good idea to review your credit report in advance.

Answer this question here to help you better understand where you may currently stand.

Do you have established credit?

Yes: Great! Keep making those payments on time. Avoid applying for more credit as it will lower your credit score. Every point counts!

No: Start building your credit now. A credit card or secure loan is a great option. But the length of history is important followed by the amounts you owe.

Find out what your score is and see where it falls. If you’re not sure if it’s strong enough or where to focus your energy to improve it, meet with a professional for expert advice on your situation.

#2 Explore Down Payment Options

Your next option is to investigate down payment mortgage programs so you can get a feel for what you’ll need to save to buy a home. Greenway Mortgage offers a variety of down payment programs and first-time homebuyer programs. We’ll see which program best suits your personal needs.

Check Out Some Of Our Programs Here:

#3 Think About Your Future Home and Your Needs

What is it that you want in a home? Here are some questions to ask yourself:

- What type of home do you picture yourself living in?

- What are your wants and needs in a home?

- How many bedrooms and bathrooms do you want?

- Do you need extra space for a home gym, a home office, or for entertaining>?

- Do you want to live in a detached home, a condo, or a townhouse?

While buying a home solo can feel like a big challenge, it doesn’t have to be. If you lean on the professionals, they can help you navigate these waters and make sure you’re able to take advantage of the great opportunities in today’s housing market (like low mortgage rates) to buy your dream home.

Bottom Line

The share of sole-person households is growing. If you’re looking to buy a home on your own, be confident that the dream is achievable. When you’re ready to begin your search, work with the experts at Greenway Mortgage so you have advice each step of the way.

Helpful Home Buying Resources

Check out some of our home buying resources here:

Are you a first-time home buyer or thinking about buying a home soon? Greenway Mortgage wants you to feel ready and prepared for the biggest, most exciting purchase of your life. We put together some questions for you to answer so that you can see where you stand currently. Go through and answer each and at the end, if you feel confident and ready, reach out to the team at Greenway Mortgage.

Alright, here we go!

#1 Do you have established credit?

Look below to see where your credit score falls.

If you answered yes, keep making your payments on time. Do not apply for any more credit as it will lower your credit score. Every point counts.

-

Excellent Credit Score: 720-850

-

Good Credit Score: 690-719

-

Fair Credit Score: 630-689

-

Bad Credit Score: 300-629

If you answered no, now is a great time to start building your credit. A credit card or secure loan is a great option. But length of history is important followed by amounts you owe.

#2 How About Your Job?

Two years of employment history is a good rule of thumb. Greenway Mortgage will look at your documented income such as paystubs, tax returns and W2’s.

#3 Have You Been Saving?

You will want to decide how much of a down payment you plan to put down. Keep in mind, that there will be other fees at closing in addition to your down payment. Closing costs can includes fees like:

-

Appraisal

-

Attorney

-

Home Inspection

-

Credit Report

-

Escrow

-

Title

-

Private Mortgage Insurance

-

Property Tax

-

Recording Fees

-

Underwriting & Processing Fees

-

And more

#4 How Much Can You Afford?

It's an important step to determine how much house you will be able to afford. With that said, there is a general rule of thumb that says your total monthly debt – mortgage payments, car payments, credit cards, gas, utilities, etc. – should not exceed 36 percent of your gross monthly income. Lenders typically follow a similar guideline when a qualifying a borrower for a mortgage, although the exact criteria depends on the lender, the borrower and the mortgage program.

The lender qualifies a borrower for a maximum monthly payment that they can afford based on the borrower’s current financial situation, as well as the down payment amount. Remember, your monthly mortgage payment includes PITI – principle, interest, taxes, and insurance.

Second, just because you qualify for a certain monthly payment, that doesn’t mean you should purchase a home that puts you right at that limit or anything close to it. “But wait,” you say. “I’ve crunched the numbers in my monthly budget, and I have no doubt that I can swing that payment with plenty left to spare!”

Are you sure about that?

Do you plan to have kids? Will they go in daycare? If you plan to stay home with your kids, how much income will you lose? Will you start saving for their education? Do you plan to buy a car within the next five years? Would you like to go on vacation? Will this home you’ve fallen in love with require any improvements? In other words, if these or other life events add significantly to your monthly expenses, will you still be able to swing that mortgage payment? Many first-time home buyers become house poor because they buy based on today and fail to consider where they’ll stand tomorrow.

The Better Question to Ask

First-time buyers constantly come to us and say, “How much house can I afford?” Unfortunately, we can’t answer that question with any certainty. We can only tell you how much of a monthly payment you qualify for. The better question to ask is, “How much should I buy?” Again, the lender can’t answer that question. That’s a personal decision you must make based on your income, lifestyle, family situation, and priorities, both now and in the future.

There is no mathematical formula that tells you exactly how much home you could afford. However, Greenway Mortgage will take the time to discuss these issues with you instead of simply approving you for a mortgage and wishing you luck.

#5 Did You Know There are First-Time Home Buyer Perks?

Greenway makes buying for the first-time easy! Check out some of our First-Time Home Buyer Programs here.

-

No Money Down FHA Loan: Eligible buyers can get 100% financing towards the purchase of a new home. Learn more about our No Money Down FHA Loan here.

-

NJ FHA Down Payment Assistance Program: Qualified buyers can receive $10K towards down payment. Learn more about our NJ FHA DPA Program here.

-

Conventional 97 First-Time Home Buyer Program: 3% down payment regardless of income levels or geographic location. Learn more about our Conventional 97 First-time home buyer program here.

-

FHA Mortgage: These loans are designed to help first-time homebuyers and experienced homeowners alike by providing them with a low-down payment option. FHA mortgage insurance serves as protection for lenders in the event of a homeowner defaulting on their home loan. Click here to learn more about the FHA Mortgage.

-

HomeReady Program: Designed to help creditworthy homebuyers with limited income in designated areas. Click here to learn more about our HomeReady Program.

You Can Check out all our First-Time Homebuyer Resources here.

First Time Home Buyer Guide

Want to feel prepared before making the leap into homeownership? If so, this eBook is for YOU! You’ll learn how to navigate the entire process from pre-approval to closing and beyond. Click here for your free First-Time Home Buyer Guide.

#6 Feeling Good About Homeownership?

If you’ve made it this far and feel confident, it’s time to schedule an appointment with one of our Loan Experts. Otherwise, hopefully you now know some things you may need to work on based on your current situation. Either way, homeownership is possible! There are many options available to fit your specific needs and the Greenway Team is here to help guide you ever step of the way.

Best of luck on this journey to becoming a homeowner!

In many areas, prospective homebuyers understand how difficult the housing market has been. Inventory is tight, prices are up, and competition is intense. In fact, the nation is experiencing one of the most competitive housing markets in history. If you’ve been searching for a home, you can agree.

What’s Happening with The Real Estate Market?

Homebuyers are finding it hard to compete with other buyers who are making offers well above the asking price. That’s when a good strategy comes into play to ensure your offer gets accepted. One way is to make a cash offer. Making an all-cash offer is a competitive step to secure the home of their dreams, but many all-cash homebuyers don’t want to tie up their cash permanently.

We’re Helping Clients Win the Home of Their Dream

Greenway Mortgage has the solution. With our Delayed Mortgage Financing Program, homebuyers are able to win bidding wars with an all-cash offer upfront, close with their cash reserves, and recoup their assets once the transaction closes without having to wait for the traditional 6-month seasoning requirement.

What is Delayed Financing?

Delayed Financing is a unique financing option that allows home buyers to obtain a mortgage loan after purchasing a property in all cash. By utilizing a "delayed financing" cash-out refinance option, borrowers can recapture their funds and waive the 6-month cash-out seasoning requirement

How Does Delayed Financing Work?

Delayed financing gives homebuyers the power of a cash offer while also allowing them to get a mortgage on a home.

- A borrower purchases a property from a seller in all cash.

- Apply for the Delayed Mortgage Program (application must be made within 6 months of the closing date).

- Borrowers utilize the cash received at closing to replenish the cash used to acquire the property.

Keep in mind that this is still a loan. Borrowers need to apply for the mortgage loan, supply the required documentation and pay back the loan.

What Are the Benefits of Delayed Financing?

Amidst a purchase season that’s highly competitive, delayed financing is a valuable mortgage financing tool when home buyers need to more quickly & strategically. Here are three key benefits:

- Beat out the competition with a stronger cash offer

- Consider a broader range of properties

- Allows investors to remain liquid

For more information and details on our Delayed Mortgage Program click here.

Bottom Line:

In this highly competitive housing market, a cash offer is key to closing the deal on a new home. Delayed Financing may be the right strategy for you to beat out the competition. Don’t get discouraged, the home of your dreams will come along! Experts expect bidding wars to ease in 2022, so there’s some light at the end of the tunnel for homebuyers.

In the meantime, if you’re interested in seeing what homes are going for in your neighborhood or in a neighborhood you’re looking to purchase in, check out our Recent Sales Tool here. Simply plug in an address and we’ll create a list of recently sold properties nearby!

Happy House Hunting!

Helpful Resources:

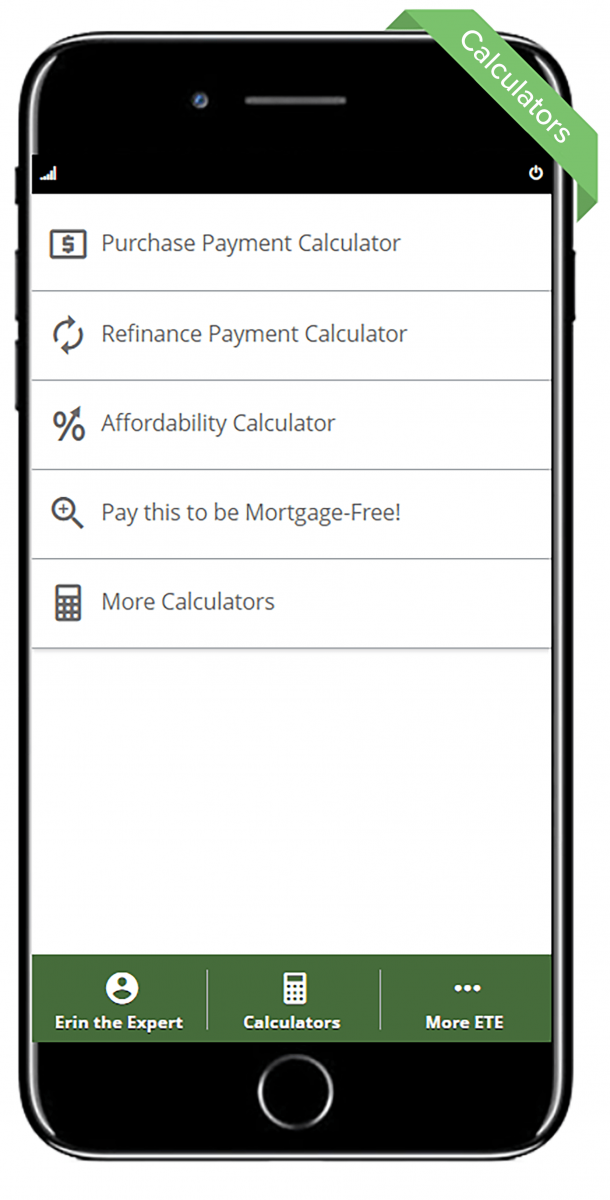

Erin The Expert’s Mobile Mortgage App

Home financing at your fingertips!

It’s no secret that apps have changed the way we complete every day tasks, how we communicate with each other, how we work and how we play. In order the provide the absolute best mortgage service to our clients, we’ve created a Mobile Mortgage App.

Erin the Expert is excited to offer clients a fast and simple way to apply, qualify and have access to a wide variety of tools and features. In fact, her app has changed the way our customers experience the home guying process in big ways!

Not only does the it provide you with tools, but you’ll be able to connect with Erin the Expert and your Real Estate Agent anytime, anywhere!

Whatever your mortgage needs – buying a home, building, refinancing or investing, this app will help you to navigate the options and decisions you’ll need to make. If you’re not quite ready to start the lending journey, that’s okay. There are a lot of helpful features inside this app. Keep reading to find out!

Erin’s Mortgage App allows you to do everything from running mortgage calculators to getting a free pre-approval and applying online, to receiving real-time updates on the status of your loan all form the comfort of your couch.

Here are a few reasons to download the mobile app before you start your home search:

Mortgage Calculators

We have a variety of easy-to-use mortgage calculators such as:

-

Purchase Payment Calculator

-

Refinance Payment Calculators

-

Affordability Calculator

-

Mortgage-Free

-

Future Value

-

And much more!

Free Pre-Approval

Going to an open house, but don’t have a pre-approval? Simply log on to the app to receive a free pre-approval and a pre-approval letter tailored just for you!

Loan Program Information

Learn about the unique loan programs Greenway Mortgage has to offer including First-Time Home Buyer Programs, Down Payment Assistance Programs, Construction Loan Programs and more!

Trigger Lead Opt-Out and Protection

Stop the marketing barrage before it stops by opting out immediately. We’ll provide you with the link you need to do so..png)

Document Scanner

Don’t have a fax machine? We didn’t think so! No one does these days. Our document scanner allows you to send your loan docs safely and easily to Erin the Expert all from your phone while using the app!

First-Time Home Buyer Resources

If you’re a first-time home buyer you can gain access to our free first-time home buyer resource page where you’ll learn everything you need to know about the home buying process, programs and more!

Accessibility To Connect with Erin the Expert

There’s no replacement for a real, live human when you have important questions regarding home buying. When you open the app, you’ll have the ability to call, text, email, and schedule a meeting with Erin. It’s all at your fingertips when you download Erin’s Mobile Mortgage App!

Convenience of a Modern Mortgage

We understand that everyone’s busy. That’s why we created this app, to make life easy! As your local mortgage lender, we want to get things done in a timely fashion. The app allows you to multi-task, get updates and information, receive a rate quote, and connect when you need to so that you can life your life and not worry about your mortgage. We’ll handle that!

Download The Mobile Mortgage App

Now’s the time to download the app! Click here to have the app downloaded directly to your phone.

Bidding wars seemed to be the norm in 2021. And if you were searching for a home, you know this to be true. Will bidding wars still be a thing in 2022?

According to a Redfin report, 72% (nearly 2 in 3) of homebuyers faced a bidding war last year. Bidding wars made an already challenging, pricy real estate market even more so. Some buyers were forced to waive contingencies, skip inspections, and make offers well above the asking price just to get ahead of the competition! In addition, there were even some homebuyers who made all-cash offers which made the competition even steeper. Surely, this can make anyone feel rushed when trying to make one of the biggest decisions of their life.

If you’re currently on the hunt for the home of your dreams, don’t feel discouraged. Be patient and the right house will come along. According to Redfin, in November 2021, the bidding war rate hit its lowest point since 2020, with just 60% of buyers coming up against one. So, will the trend continue as we move further into 2022? Can buyers expect a less competitive market? The answer is yes. Those bidding war days are behind us as they are starting to dwindle, giving buyers more room to make decisions. Here are a few reasons why we’ll see fewer bidding wars:

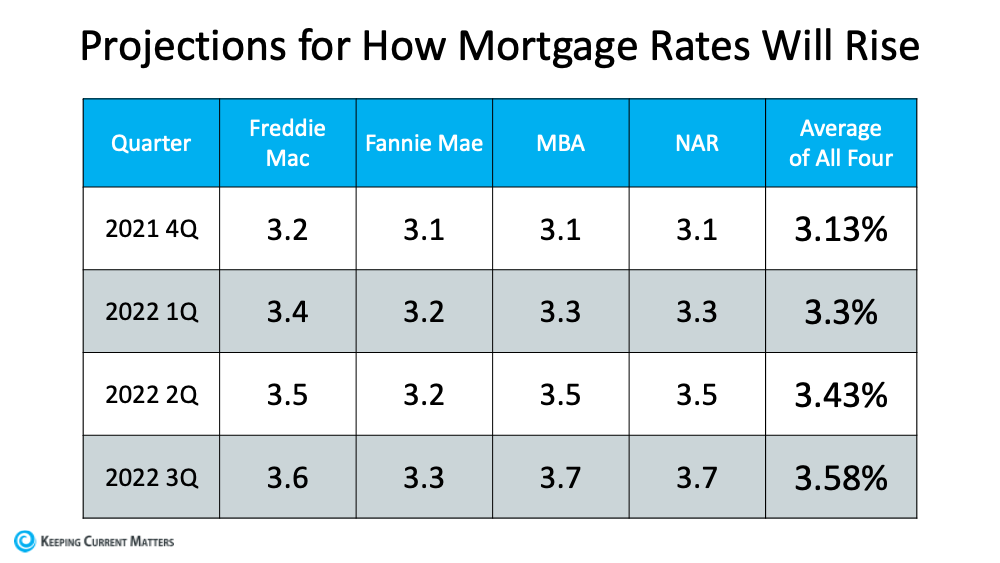

Mortgage Rates are Rising

Yes, rates are still at historic lows, but most experts predict a continued rise in rates as the year continues. Fannie Mae predicts average rates around 3.2% by 2022’s end while others have a more bullish view, projecting 4% for the year (Mortgage Bankers Association). Without a doubt, rate increases are in the cards. As a result, this will dampen buyer demand. With fewer buyers comes fewer bidding wars and an easier market for those looking for their dream home.

Inflation Has Buyers Pulling Back

Inflation is on the rise. In fact, the Consumer Price Index increased 7% over the last 12 months as of December, marking the highest inflation rate seen in nearly 40 years. This has worried many consumers. Sadly, many have called it quits on their homebuying dreams. According to a Redfin survey, 29% of respondents said rising inflation has caused them to delay buying a home. The survey also stated that 11% had given up on home buying altogether. Inflation, just like rising rates, is another factor that should help alleviate competition and reduce bidding wars.

Supply is Expected to Increase

If you’ve been house hunting, you’ve seen the low inventory of houses on the market. The limited housing supply had a lot to do with last year’s housing market. However, as the year goes on, experts say inventory will rise as we get further into 2022. Redfin predicts new listings will surpass 7.6 million this year, the biggest share since 2018, while Realtor.com is betting on a 0.3% increase in inventory for 2022. Increasing construction will help the pressure on supply as well. Don’t get discouraged, there is light at the end of the tunnel for home buyers.

What Can You Do Now So You’re Prepared to Buy Your Dream Home?

In today's highly competitive housing market, you'll want to make sure you are pre-approved first! Pre-approval gives you an advantage if you get into a multiple-offer scenario, and these days, it’s likely you will. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war. Overall, it’s better to be prepared now and ready for when you find that perfect home. So, make sure to get pre-approved first.

Benefits of Getting Pre-Approved

-

You’ll know how much you can afford.

-

Shows you’re qualified.

-

Negotiate a better deal as the pre-approval removes uncertainty for the seller.

-

Beat out the competition.

-

Reduce time and close your loan faster.

-

Move one step closer to homeownership.

How to Prepare for a Bidding War

If you do come face to face in a bidding war situation, we want you to be prepared, especially if you’ve found the home of your dreams. Being prepared means you'll be able to move quickly and confidently in today's competitive market. Check out these Bidding War Tips:

-

Have your pre-approval letter in hand.

-

Know what you can afford. You’ll want to make the highest offer, but don’t ignore your budget. Bidding wars can get emotional, but you must be able to walk away if it doesn’t make sense for your financial situation.

-

Make your best offer. Speak with your real estate agent. Find out how much competition there is. They will help you determine what factors might make your offer more enticing like flexible move-in dates, competitive offer price, minimal contingencies.

-

Write a Personal Letter to the sellers. Click here to learn how to write an award-winning Real Estate Offer Letter.

-

If you can, offer an all-cash deal.

-

Drop the contingencies.

-

Be available. Make sure to leave your information with the seller and invite them to contact you or your agent with any questions about your offer. Finally, respond to inquiries quickly and be flexible.

Bottom Line:

In today’s competitive market it’s best to be prepared and to arm yourself with as much home buying knowledge as possible. Although it may be challenging to find a home right now, as we get further into 2022, things will improve. Bidding wars should lessen, making home buying easier for those on the hunt.

.png)

.png)