Bidding wars seemed to be the norm in 2021. And if you were searching for a home, you know this to be true. Will bidding wars still be a thing in 2022?

According to a Redfin report, 72% (nearly 2 in 3) of homebuyers faced a bidding war last year. Bidding wars made an already challenging, pricy real estate market even more so. Some buyers were forced to waive contingencies, skip inspections, and make offers well above the asking price just to get ahead of the competition! In addition, there were even some homebuyers who made all-cash offers which made the competition even steeper. Surely, this can make anyone feel rushed when trying to make one of the biggest decisions of their life.

If you’re currently on the hunt for the home of your dreams, don’t feel discouraged. Be patient and the right house will come along. According to Redfin, in November 2021, the bidding war rate hit its lowest point since 2020, with just 60% of buyers coming up against one. So, will the trend continue as we move further into 2022? Can buyers expect a less competitive market? The answer is yes. Those bidding war days are behind us as they are starting to dwindle, giving buyers more room to make decisions. Here are a few reasons why we’ll see fewer bidding wars:

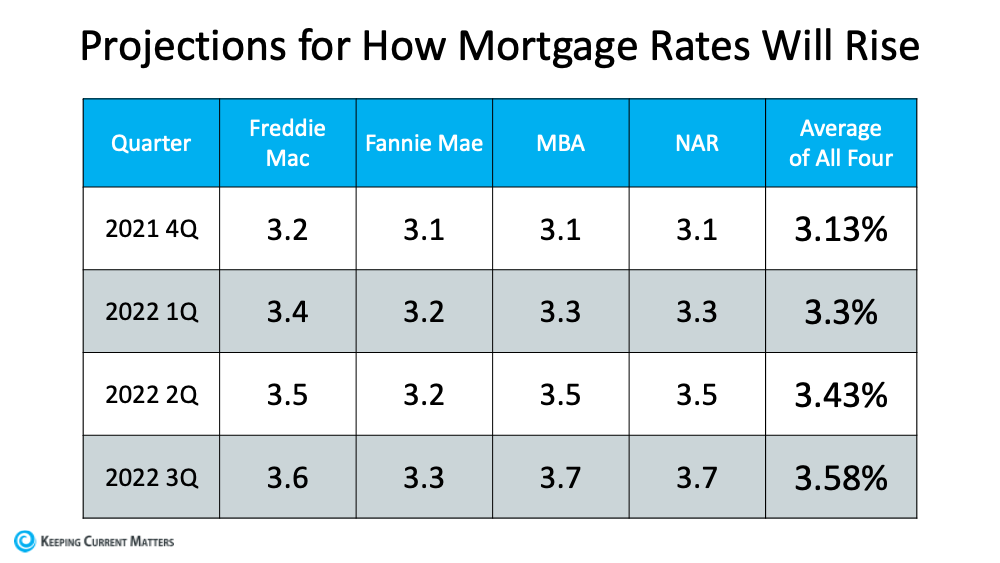

Mortgage Rates are Rising

Yes, rates are still at historic lows, but most experts predict a continued rise in rates as the year continues. Fannie Mae predicts average rates around 3.2% by 2022’s end while others have a more bullish view, projecting 4% for the year (Mortgage Bankers Association). Without a doubt, rate increases are in the cards. As a result, this will dampen buyer demand. With fewer buyers comes fewer bidding wars and an easier market for those looking for their dream home.

Inflation Has Buyers Pulling Back

Inflation is on the rise. In fact, the Consumer Price Index increased 7% over the last 12 months as of December, marking the highest inflation rate seen in nearly 40 years. This has worried many consumers. Sadly, many have called it quits on their homebuying dreams. According to a Redfin survey, 29% of respondents said rising inflation has caused them to delay buying a home. The survey also stated that 11% had given up on home buying altogether. Inflation, just like rising rates, is another factor that should help alleviate competition and reduce bidding wars.

Supply is Expected to Increase

If you’ve been house hunting, you’ve seen the low inventory of houses on the market. The limited housing supply had a lot to do with last year’s housing market. However, as the year goes on, experts say inventory will rise as we get further into 2022. Redfin predicts new listings will surpass 7.6 million this year, the biggest share since 2018, while Realtor.com is betting on a 0.3% increase in inventory for 2022. Increasing construction will help the pressure on supply as well. Don’t get discouraged, there is light at the end of the tunnel for home buyers.

What Can You Do Now So You’re Prepared to Buy Your Dream Home?

In today's highly competitive housing market, you'll want to make sure you are pre-approved first! Pre-approval gives you an advantage if you get into a multiple-offer scenario, and these days, it’s likely you will. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war. Overall, it’s better to be prepared now and ready for when you find that perfect home. So, make sure to get pre-approved first.

Benefits of Getting Pre-Approved

-

You’ll know how much you can afford.

-

Shows you’re qualified.

-

Negotiate a better deal as the pre-approval removes uncertainty for the seller.

-

Beat out the competition.

-

Reduce time and close your loan faster.

-

Move one step closer to homeownership.

How to Prepare for a Bidding War

If you do come face to face in a bidding war situation, we want you to be prepared, especially if you’ve found the home of your dreams. Being prepared means you'll be able to move quickly and confidently in today's competitive market. Check out these Bidding War Tips:

-

Have your pre-approval letter in hand.

-

Know what you can afford. You’ll want to make the highest offer, but don’t ignore your budget. Bidding wars can get emotional, but you must be able to walk away if it doesn’t make sense for your financial situation.

-

Make your best offer. Speak with your real estate agent. Find out how much competition there is. They will help you determine what factors might make your offer more enticing like flexible move-in dates, competitive offer price, minimal contingencies.

-

Write a Personal Letter to the sellers. Click here to learn how to write an award-winning Real Estate Offer Letter.

-

If you can, offer an all-cash deal.

-

Drop the contingencies.

-

Be available. Make sure to leave your information with the seller and invite them to contact you or your agent with any questions about your offer. Finally, respond to inquiries quickly and be flexible.

Bottom Line:

In today’s competitive market it’s best to be prepared and to arm yourself with as much home buying knowledge as possible. Although it may be challenging to find a home right now, as we get further into 2022, things will improve. Bidding wars should lessen, making home buying easier for those on the hunt.

MarketMinute | See what's almost returned to pre-pandemic levels

|

Inflation is expected to peak close to 9% in the coming months, as the Russian/Ukraine war drives up the cost of raw materials and energy. |

|

President Joe Biden signed an executive order on Wednesday, calling on government to examine the risks and benefits of cryptocurrencies. |

|

Jobs data last week showed a surprisingly strong 678K new jobs were created in February, as unemployment fell to 3.8%. |

|

The mortgage industry originated a record $4.4 trillion last year, led by record purchase lending volume and surging cash-out refinances. |

|

At 3.3%, the national delinquency rate for first lien mortgages is almost even with pre-pandemic levels and near the record low set in Jan 2020. |

|

Applications for a mortgage to purchase a home increased 9% from the previous week but were 7% lower than the same week one year ago. |

You may have heard the term rate lock before. Rate locks can save you thousands of dollars over the time you hold the mortgage loan, but what exactly are they and how do they work?

Mortgage interest rates are constantly moving up and down throughout the day and daily. During the underwriting and process stages of a mortgage, rates can fluctuate. Getting a mortgage rate lock is a way to keep your interest rate from moving higher before closing day.

What is a mortgage rate lock?

A rate lock, also known as rate protection, keeps your interest rate from rising between the time you apply for a mortgage and the time you close on your new loan.

A mortgage lender will set aside the necessary funds and “lock” loan terms and interest rates. In essence, think of a lock as your “RSVP”; the mortgage lender sets aside necessary funds for your transaction, and they will assume the risk of rates rising during the lock period.

Locking a rate allows clients to get the best mortgage rate possible while going through the refinancing or purchasing process. For example, if Greenway Mortgage locks in your rate at 3.5 percent for 45 days and rates jump to 4.5 percent within that period, you’ll get your loan at a lesser rate.

How long does the rate lock last?

The moment a loan is locked, the clock starts ticking! Lock periods typically last from 30 to 60 days, though in markets where the loan approval process is slow, the lock period can last as long as 90 days. The shorter the period that the lender locks a rate, the more beneficial to you in terms of the overall cost.

How does the length of a rate lock affect your cost?

In mortgage lending, almost every cost factor comes down to one variable—risk. You will generally find that the more risk a client is willing to assume, the better rates and terms a lender is willing to offer. Conversely, when a lender assumes more risk, they tend to counter that risk with higher costs. In this case, the longer a lender guarantees an interest rate, the larger a buffer they will require to offset that risk.

How much does a rate lock cost?

It depends as every mortgage lender is different. It also comes down to the amount and term of the loan. Some lenders do charge for a rate lock, though others offer one for free. But not everything is free. The fee may be included in the rate you were offered. Speak with your lender for more information.

Is a mortgage rate lock worth it?

The benefits of a rate lock outweigh the risk. If you want to protect your homebuying power, it may be worth it. The rate lock is about preventing your mortgage payment from going up due to possible rate hikes before closing. Not locking a rate can mean having to come up with a higher down payment if rates did go up. Given where mortgage rates are at today and the possibility of them going higher, getting a rate lock can pay off!

What happens if you commit to locking a loan and you do not close in that period?

Sometimes, conditions arise that delay the process, and loan locks "expire" before a lender can close the transaction. In this case, the lender will typically grant an extension on the lock period but at an additional cost. An expiring loan lock does not typically jeopardize the overall likelihood of the loan's closing.

Bottom Line

If you have a good mortgage rate, lock it. Mortgage rate locks may protect you from rising rates and give you peace of mind. Speak with Greenway Mortgage for more information. The security of protecting yourself from rate spikes is worth it.

MarketMinute | How long have typical owners lived in their homes?

|

According to payroll processor ADP, private companies added 475k new jobs in February. ADP also revised January's report upward by 801K. |

|

In his testimony before Congress, Fed Chair Jerome Powell said he still expects a quarter point Fed policy rate hike at this month's meeting. |

|

New jobless claims came in at 215k, the lowest this year. Continuing claims' 4-week average fell to 1.48 million, the lowest since 1970. |

|

Pending home sales were down 5.7% in January, continuing what is now a 3-month drop in transactions as inventory remains at an all-time low. |

|

Record increases in home prices translate to record levels of equity for homeowners. The average mortgage holder has $185K in equity. |

|

According to Redfin, U.S. homeowners had lived an average of 13.2 years in their homes in 2021, up from the 10.1-year average a decade ago. |

FHFA Releases Home Price Index and Values are up 17.5% YOY

The Federal Housing Finance Agency released its House Price Index for Q4 of 2021 and home prices were up 17.5% year over year. Your area's details can be found in my Real Estate Appreciation Data Report.

What could this mean for you as a homeowner?

-

You may be able to drop private mortgage insurance and lower your monthly payment

-

Take cash out for home improvements, debt consolidation, tuition payments, or any other purpose

When values are high, a refinance could be worth exploring.

Are you thinking of buying?

High home prices can impact affordability, as can rising interest rates. Fortunately, rates are still below historical norms and prices continue to rise due to low inventory and high demand in most areas.

Reach out to discuss your scenario before rates get any higher!

.jpg)

.png)

.png)