|

Fed Chair Jerome Powell commented this week that "inflation is much too high" and the Fed would raise policy rates until it is under control. |

|

Supply chain issues caused factory durable goods orders to fall more than expected in February, snapping a 5-month streak of increases. |

|

Last week's jobless numbers hit the lowest level since 1969. Fed Chairman Powell described the labor market as "tight to an unhealthy level." |

|

February’s existing home sales fell more than expected, down 7.2% from January, as mortgage rates rose and supply remained tight. |

|

New home sales also dropped in February, falling 2% for a second straight monthly decline. They were still above their pre-pandemic level. |

|

Quickly rising mortgage rates contributed to a 2% decline in purchase applications last week. Apps were 12% lower year over year. |

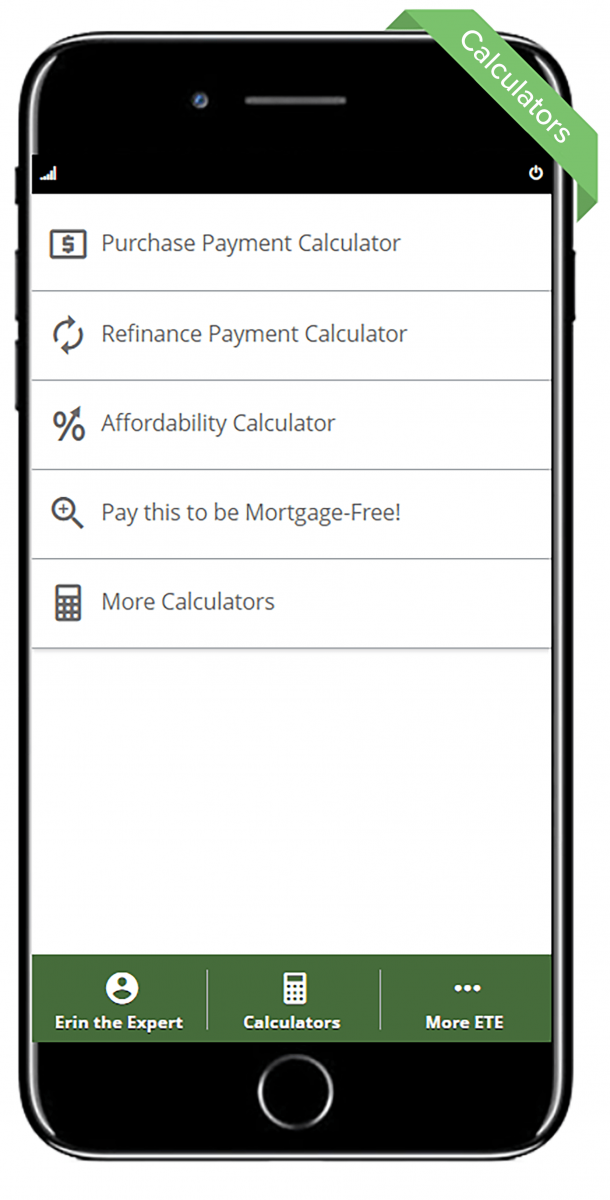

Erin The Expert’s Mobile Mortgage App

Home financing at your fingertips!

It’s no secret that apps have changed the way we complete every day tasks, how we communicate with each other, how we work and how we play. In order the provide the absolute best mortgage service to our clients, we’ve created a Mobile Mortgage App.

Erin the Expert is excited to offer clients a fast and simple way to apply, qualify and have access to a wide variety of tools and features. In fact, her app has changed the way our customers experience the home guying process in big ways!

Not only does the it provide you with tools, but you’ll be able to connect with Erin the Expert and your Real Estate Agent anytime, anywhere!

Whatever your mortgage needs – buying a home, building, refinancing or investing, this app will help you to navigate the options and decisions you’ll need to make. If you’re not quite ready to start the lending journey, that’s okay. There are a lot of helpful features inside this app. Keep reading to find out!

Erin’s Mortgage App allows you to do everything from running mortgage calculators to getting a free pre-approval and applying online, to receiving real-time updates on the status of your loan all form the comfort of your couch.

Here are a few reasons to download the mobile app before you start your home search:

Mortgage Calculators

We have a variety of easy-to-use mortgage calculators such as:

-

Purchase Payment Calculator

-

Refinance Payment Calculators

-

Affordability Calculator

-

Mortgage-Free

-

Future Value

-

And much more!

Free Pre-Approval

Going to an open house, but don’t have a pre-approval? Simply log on to the app to receive a free pre-approval and a pre-approval letter tailored just for you!

Loan Program Information

Learn about the unique loan programs Greenway Mortgage has to offer including First-Time Home Buyer Programs, Down Payment Assistance Programs, Construction Loan Programs and more!

Trigger Lead Opt-Out and Protection

Stop the marketing barrage before it stops by opting out immediately. We’ll provide you with the link you need to do so..png)

Document Scanner

Don’t have a fax machine? We didn’t think so! No one does these days. Our document scanner allows you to send your loan docs safely and easily to Erin the Expert all from your phone while using the app!

First-Time Home Buyer Resources

If you’re a first-time home buyer you can gain access to our free first-time home buyer resource page where you’ll learn everything you need to know about the home buying process, programs and more!

Accessibility To Connect with Erin the Expert

There’s no replacement for a real, live human when you have important questions regarding home buying. When you open the app, you’ll have the ability to call, text, email, and schedule a meeting with Erin. It’s all at your fingertips when you download Erin’s Mobile Mortgage App!

Convenience of a Modern Mortgage

We understand that everyone’s busy. That’s why we created this app, to make life easy! As your local mortgage lender, we want to get things done in a timely fashion. The app allows you to multi-task, get updates and information, receive a rate quote, and connect when you need to so that you can life your life and not worry about your mortgage. We’ll handle that!

Download The Mobile Mortgage App

Now’s the time to download the app! Click here to have the app downloaded directly to your phone.

MarketMinute | How are homebuilders feeling these days?

|

Wholesale inflation climbed 0.8% in February, lower than estimates but still up 10% from last year, tying January for the biggest gain ever. |

|

February’s retail sales were lower than expected. The 0.3% gain shows consumers continued to spend but were impacted by rising prices. |

|

As anticipated, the Fed raised policy rates 0.25% this week to help fight inflation, which has driven up mortgage rates recently. |

|

Homebuilder sentiment is still very bullish, though it is down slightly from its recent peak due to higher mortgage rates and rising construction costs. |

|

New housing starts rebounded sharply in February, as the drag from cold weather eased. Permits fell slightly but remain at high levels. |

|

Purchase applications were up 1% for the week. However, rising mortgage rates have dampened refi demand, with apps down 49% from a year ago. |

Bidding wars seemed to be the norm in 2021. And if you were searching for a home, you know this to be true. Will bidding wars still be a thing in 2022?

According to a Redfin report, 72% (nearly 2 in 3) of homebuyers faced a bidding war last year. Bidding wars made an already challenging, pricy real estate market even more so. Some buyers were forced to waive contingencies, skip inspections, and make offers well above the asking price just to get ahead of the competition! In addition, there were even some homebuyers who made all-cash offers which made the competition even steeper. Surely, this can make anyone feel rushed when trying to make one of the biggest decisions of their life.

If you’re currently on the hunt for the home of your dreams, don’t feel discouraged. Be patient and the right house will come along. According to Redfin, in November 2021, the bidding war rate hit its lowest point since 2020, with just 60% of buyers coming up against one. So, will the trend continue as we move further into 2022? Can buyers expect a less competitive market? The answer is yes. Those bidding war days are behind us as they are starting to dwindle, giving buyers more room to make decisions. Here are a few reasons why we’ll see fewer bidding wars:

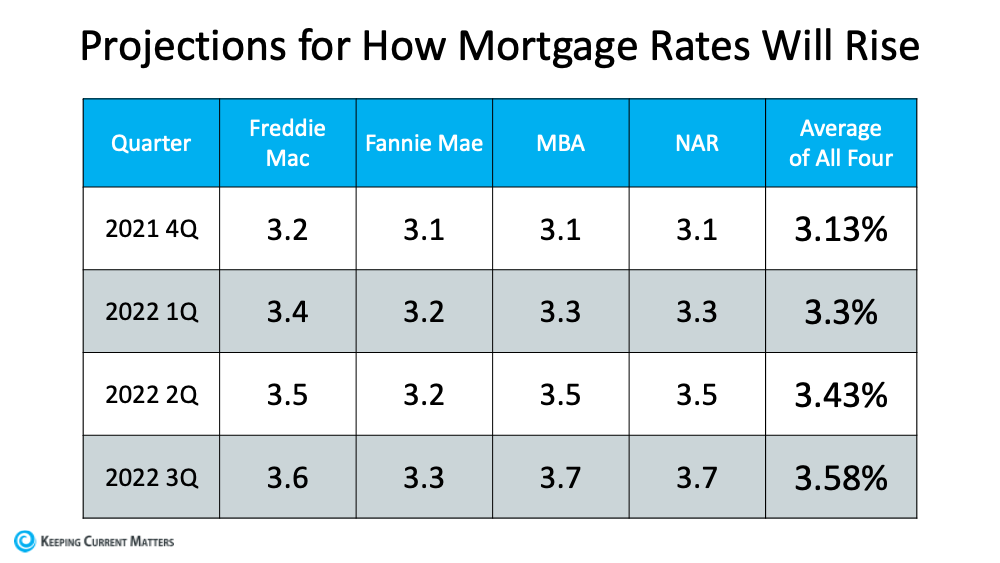

Mortgage Rates are Rising

Yes, rates are still at historic lows, but most experts predict a continued rise in rates as the year continues. Fannie Mae predicts average rates around 3.2% by 2022’s end while others have a more bullish view, projecting 4% for the year (Mortgage Bankers Association). Without a doubt, rate increases are in the cards. As a result, this will dampen buyer demand. With fewer buyers comes fewer bidding wars and an easier market for those looking for their dream home.

Inflation Has Buyers Pulling Back

Inflation is on the rise. In fact, the Consumer Price Index increased 7% over the last 12 months as of December, marking the highest inflation rate seen in nearly 40 years. This has worried many consumers. Sadly, many have called it quits on their homebuying dreams. According to a Redfin survey, 29% of respondents said rising inflation has caused them to delay buying a home. The survey also stated that 11% had given up on home buying altogether. Inflation, just like rising rates, is another factor that should help alleviate competition and reduce bidding wars.

Supply is Expected to Increase

If you’ve been house hunting, you’ve seen the low inventory of houses on the market. The limited housing supply had a lot to do with last year’s housing market. However, as the year goes on, experts say inventory will rise as we get further into 2022. Redfin predicts new listings will surpass 7.6 million this year, the biggest share since 2018, while Realtor.com is betting on a 0.3% increase in inventory for 2022. Increasing construction will help the pressure on supply as well. Don’t get discouraged, there is light at the end of the tunnel for home buyers.

What Can You Do Now So You’re Prepared to Buy Your Dream Home?

In today's highly competitive housing market, you'll want to make sure you are pre-approved first! Pre-approval gives you an advantage if you get into a multiple-offer scenario, and these days, it’s likely you will. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war. Overall, it’s better to be prepared now and ready for when you find that perfect home. So, make sure to get pre-approved first.

Benefits of Getting Pre-Approved

-

You’ll know how much you can afford.

-

Shows you’re qualified.

-

Negotiate a better deal as the pre-approval removes uncertainty for the seller.

-

Beat out the competition.

-

Reduce time and close your loan faster.

-

Move one step closer to homeownership.

How to Prepare for a Bidding War

If you do come face to face in a bidding war situation, we want you to be prepared, especially if you’ve found the home of your dreams. Being prepared means you'll be able to move quickly and confidently in today's competitive market. Check out these Bidding War Tips:

-

Have your pre-approval letter in hand.

-

Know what you can afford. You’ll want to make the highest offer, but don’t ignore your budget. Bidding wars can get emotional, but you must be able to walk away if it doesn’t make sense for your financial situation.

-

Make your best offer. Speak with your real estate agent. Find out how much competition there is. They will help you determine what factors might make your offer more enticing like flexible move-in dates, competitive offer price, minimal contingencies.

-

Write a Personal Letter to the sellers. Click here to learn how to write an award-winning Real Estate Offer Letter.

-

If you can, offer an all-cash deal.

-

Drop the contingencies.

-

Be available. Make sure to leave your information with the seller and invite them to contact you or your agent with any questions about your offer. Finally, respond to inquiries quickly and be flexible.

Bottom Line:

In today’s competitive market it’s best to be prepared and to arm yourself with as much home buying knowledge as possible. Although it may be challenging to find a home right now, as we get further into 2022, things will improve. Bidding wars should lessen, making home buying easier for those on the hunt.

Are you a U.S. Veteran or an active-duty service member looking to build your own home? If so, your journey to building your dream home starts here with Greenway’s VA One-Time Close Construction Loan. This one-time close construction loan provides Veterans with a simple and affordable way to finance the perfect home all with just one application and one closing.

The Lowdown on the VA One-Time Close Construction Loan…

The U.S. Department of Veterans Affairs (VA) has loan options designed to help veterans make their dream home a reality. VA loans are issued by private lenders, like Greenway Mortgage, but backed by the VA. VA Construction Loans can help qualified Veterans finance the purchase of land and the construction of a brand-new home, all without the need for a down payment.

It may be the perfect time for you to use your VA Home Loan benefits, especially now when housing inventory is at its lowest! There’s certainly no reason to wait for your perfect home to become available on the market when we can offer you the VA One-Time Close Construction Loan.

Keep reading to learn more and to see if you qualify.

What are the Program Details for the VA One-Time Close Construction Loan?

-

1 time close

-

Owner Occupied (1 unit); 100% LTV

-

0% down required, depending on loan size*

-

680 min credit score

*Finance up to 90% of the project (purchase price + cost to construct). Eligibility requirements, exclusions, and other terms and conditions apply.

What are the Benefits of a VA One-Time Close Construction Loan?

Some key benefits include:

-

Consolidate construction and purchase price for only 1 set of closing costs and fees.

-

Purchase a tear down property.

-

If you already own an empty property and want to build a home, tear down, and put up a new one, or do a major renovation on an existing home.

-

Pay just interest-only payments during construction.

-

Avoid requalification post-construction.

-

Simple & flexible draw process with no set schedule.

-

Use qualified licensed builder of your choice (self-build not allowed)

What are the Alternatives to a VA One-Time Close Construction Loan?

-

USDA One-Time Close Construction Loan: meant for low to moderate income families who live in rural areas and also does not require borrowers to put any money down. Click here to learn more about the USDA Construction Loan.

-

FHA One-Time Close Construction Loan: this is another option for borrowers who might not have any ties to the military. Click here to learn more about the FHA Construction Loan.

Bottom Line

If you’re looking for a VA Construction Loan, then you’ve come to the right mortgage lender. We are proud to provide veterans and active-duty military members with financing to build the home of their dreams. Our Loan Experts will work with you from day one to ensure a smooth process. Let’s build the home of your dreams together!

How Do Construction Loans work, you might ask?

Overall Process:

- Builder Approval

- Project Approval (appraisal, plans & specs, costs from builder)

- Borrower Credit Approval

- Initial Draw at Close (up to 50K) to get a project started and/or reimburse for any materials already purchased

Construction Period

- Post close welcome call from the construction management company

- Inspections are done as work is put in place, then checks for draws issued to builder and borrower

- Once work is done, the loan is modified into a standard 30-year fixed loan at present market rates (vs. the interest-only loan in place during construction). Borrowers can pay down the balance on a converted loan in the event other property they owned has been sold in the meantime. No additional closing costs when the loan converts.

Specialized Features

-

Stalled projects

-

Modular construction

-

Major renovations (projects beyond scope of renovation programs)

Remember, Choosing an Experienced Lender is Critical

A construction loan is more complex than a standard mortgage, with more moving parts and more specialized expertise required.

Greenway Mortgage has the knowledge, experience, and proven process to guide you through the construction loan process as you build your dream home. To learn more about our construction loan program and find out if you qualify, contact us to discuss your project.

.jpg)

.png)