|

|

|

|

|

|

MarketMinute | Mortgage Rates and Prices Rising At The Same Time?

|

|

|

|

|

|

When you were younger, your home was the perfect place. Your spacious backyard provided a place for your children and even your pets to run and play. Your kitchen provided meals to feed your family and your living room and den served as the family gathering spot. During those years, the last thing you may have thought was leaving the home that you loved and made so many memories in.

However, as you enter the stage of retirement you may begin to realize you prefer to grow older in a new home that best fits this new stage in your life. For instance, your current home may be too large for your needs and having a multiple-level home with many rooms may take more work to maintain than you want.

Whatever your reasons may be, downsizing to a smaller, more manageable home is ideal.

Just think, you could purchase your new dream home with no monthly mortgage payments* with the Home Equity Conversion Mortgage (HECM).

Commonly known as a “reverse mortgage”, the Home Equity Conversion Mortgage (HECM) is a government-insured loan that allows older homeowners to convert home-equity into tax-free cash.* Perfect for borrowers who are downsizing or want to purchase a home without a monthly mortgage payment.*

PROGRAM DETAILS:

- No payment option available*

- HECMs are federally insured.

- Same products, limits, LTVs, and rates as traditional mortgages

- Excellent planning tool to fund retirement

THE FINE PRINT

- Must be 62 years old, or older

- Applies only to owner-occupied, primary residences

- Mandatory HUD counseling

- The homeowner is still responsible for property taxes, homeowners insurance, upkeep and any relevant HOA fees.

*Age-based assessment and other guidelines determine allowable equity ratios. Various payment and draw options available.

|

|

|

|

|

|

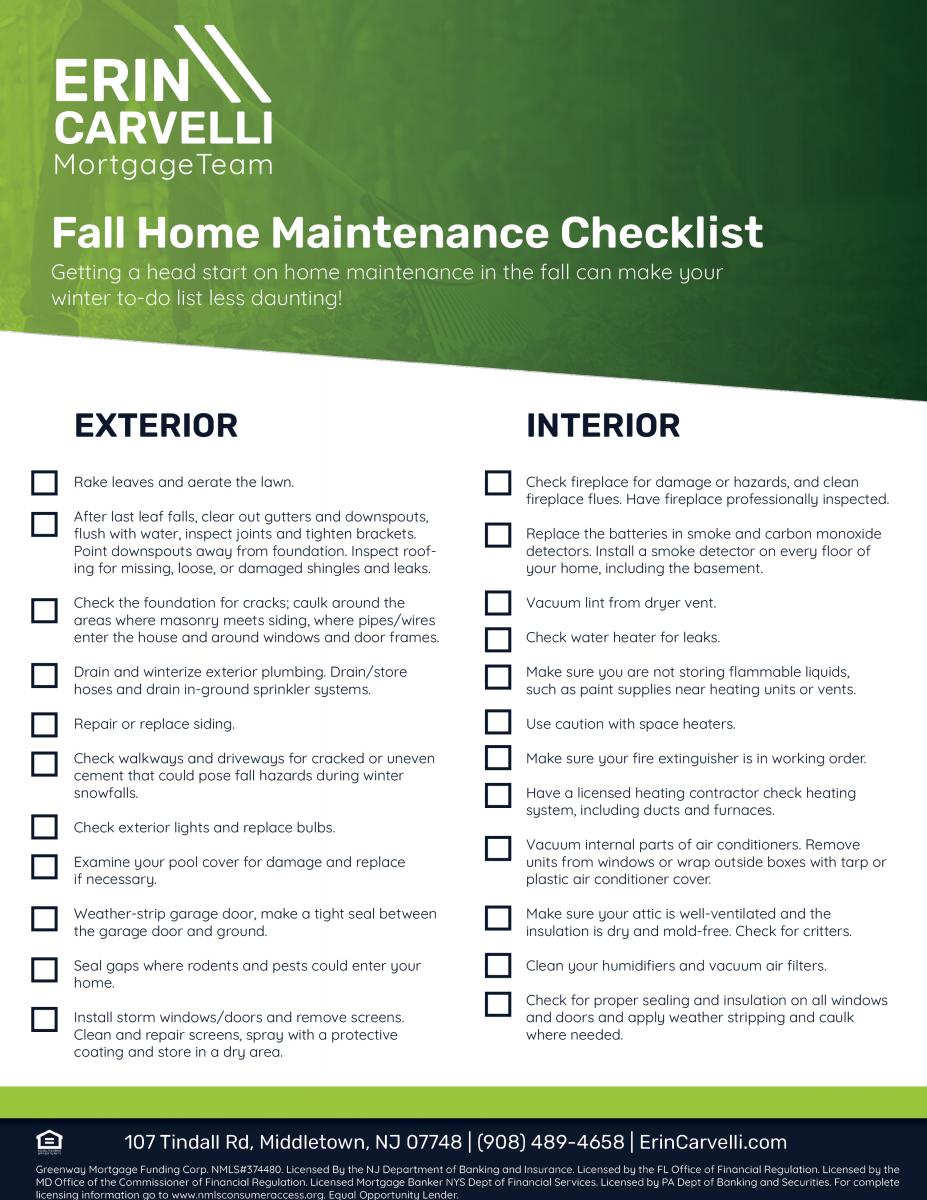

It would be amazing if all you needed to prep your home for fall was hang a wreath and light a bunch of pumpkin spice candles. While yes, those are a part of getting ready for the change of seasons, there are more important preparations that come with being a homeowner.

With that said, fall is the perfect season to tackle general home maintenance projects because the weather is generally dry and temperatures are moderate. Before you start your seasonal home maintenance checklist, examine both the interior and exterior of your home.

Most of these home maintenance items can be accomplished without the help of a professional, but it's always better to be safe and call for assistance if a home improvement project is beyond your abilities.

Tick these items off your list this season, and you can rest easy knowing that your home and yard are buttoned up and ready for winter. Happy Fall from your friends at Greenway Mortgage!

.jpg)