We understand that when it comes to your dream home, one size does not fit all. That is why Greenway Mortgage’s Jumbo Elite Mortgage Program may be the best choice to get you closer to the home of your dreams.

Rates on non-conforming loan programs have been far from competitive lately, until now. Greenway has created the Jumbo Elite Mortgage to help our well-qualified clients secure a great rate on loans up to $5 million.

If you are able to demonstrate the ability to repay and are looking for higher loan amounts with more flexible guidelines, Greenway’s Jumbo Elite Program can provide the perfect lending solution.

Features and Benefits

-

Loan Amounts Up To $5 million

-

Purchase, Rate and Term Refi, and Cash-out Refi* Programs

-

Available for Primary Residence, Second Homes, and Multi-families

-

Fixed and Adjustable Rates

-

Available in NY, NJ, PA & CT

The Fine Print

-

Minimum FICO 680

-

Up to 90 LTV based on FICO and Loan amount

* Cash-Out Refi subject to max loan amount. Eligibility requirements, exclusions, and other terms and conditions apply.

The Bottom Line

The Jumbo Elite Mortgage will give you more buying power while taking advantage of competitive interest rates. Get in touch to discuss your options and how this program can provide you more choices to help you achieve your financial goals.

|

|

|

|

|

|

More than ever, we have realized that our homes are so much more than the houses we live in. Over the past couple of years, they’ve become our workplaces, schools for our children, and a safe place where we’ve weathered the most challenging moments of a worldwide pandemic. From rural counties to bustling cities, owning a home offers an opportunity to lay down roots, start a family and embark on new beginnings.

As National Homeownership Month kicks off this June, homeowners certainly have many reasons to celebrate. Read on to learn about the non-financial and financial benefits it has to offer.

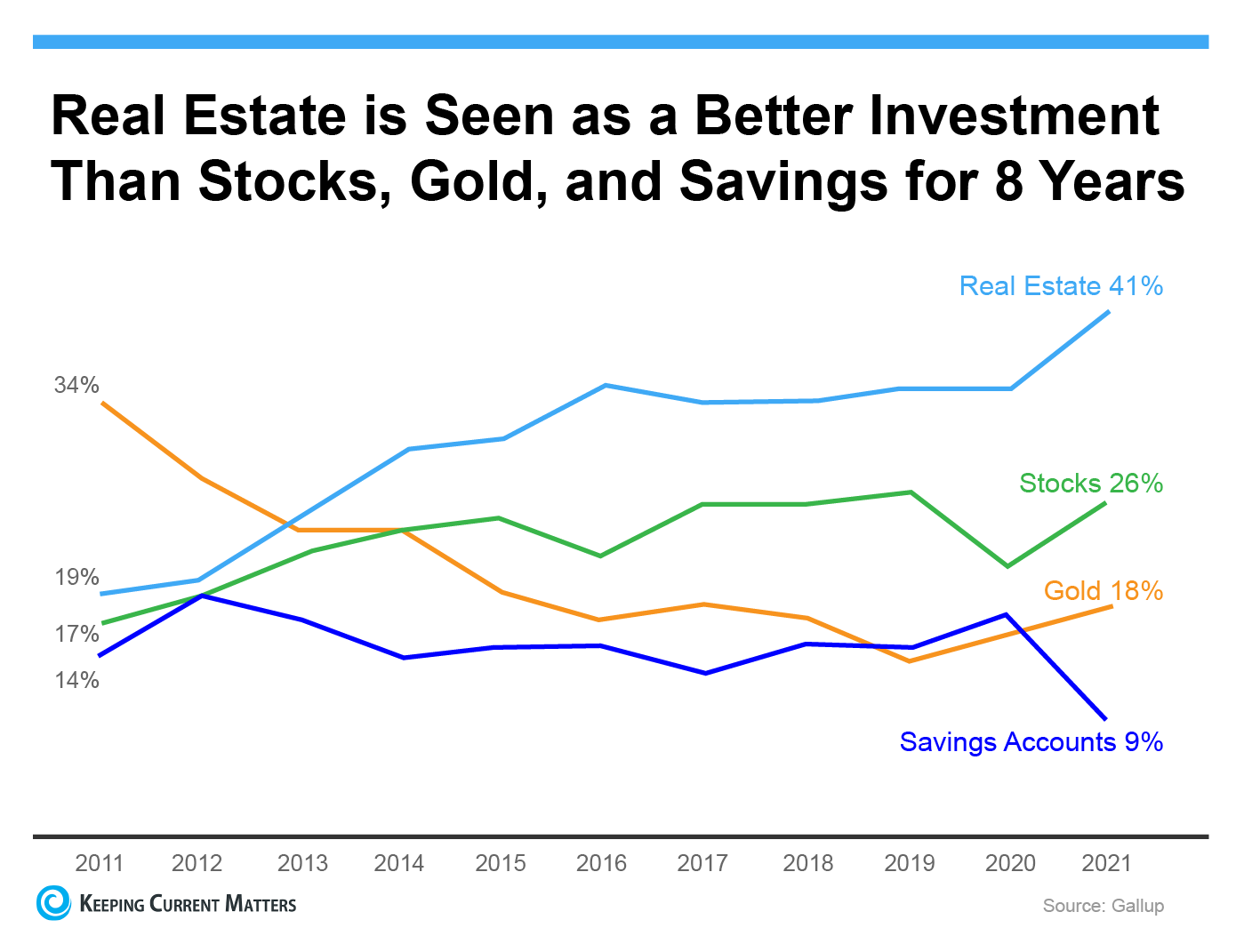

In an annual Gallup poll, Americans chose real estate as the best long-term investment. It’s not the first time it’s topped the list, either! Real estate has been on a winning streak for the past eight years, consistently gaining traction as the best long-term investment. Even when inflation is rising, like today, many Americans agree real estate is a strong investment. When you lock in a mortgage payment, you’re shielded from housing cost increases, and you own an asset that gains value over time.

How Did Homeownership Month Start?

National Homeownership Month started as a week-long celebration of homeownership during the Clinton administration in 1995. In 2002, President George W. Bush proclaimed June as the National Homeownership Month. Today, the mortgage industry continues the message of helping people realize the dream of responsible homeownership.

What Are the Non-Financial Benefits of Homeownership?

Owning a home brings you and your family happiness, satisfaction, and pride.

-

Pride of Ownership: A place to call your own. You’ll be able to customize it according to your likes and personality without anyone telling you how.

-

Civic Participation: Homeownership creates stability, and a sense of community, and increases civic engagement.

-

Provides Stability and creates a positive environment for families.

-

Provides a Safe Place: Owning gives you a sense of security and privacy. Two things that have become very valuable in our lives.

What Are the Financial Benefits of Homeownership?

Buying a home is also an investment in your and your family’s financial future.

-

Forced Savings: Your monthly mortgage payment is a form of ‘forced savings’ which builds your net worth with every payment!

-

Home Equity: Homeownership builds equity every month. You can use that equity to start a business, pay off debt, send your kids to college and so much more.

-

Appreciation: Home prices increase annually which helps to create a safety net.

-

Net worth: A homeowner's net worth is 44x greater than renters! This gives you the financial freedom to invest.

-

Stability: Rent prices may increase each year. However, a fixed mortgage payment allows you to save for future projects and guard against inflation.

-

Tax Benefits: Speak with your CPA to discuss the possible tax benefits homeownership can bring you.

Bottom Line

Homeownership is and will always be part of the American Dream. There are many financial and non-financial benefits to take advantage of when owning a home. Greenway Mortgage is proud to be a part of the industry that makes homeownership a reality for so many Americans!

If owning a home is part of your dream, reach out to us to get your journey started. And if you’re a current homeowner, take the time this June to celebrate the ways homeownership has added value to your life.

Happy Homeownership Month from your friends at Greenway Mortgage!

Home Buyer Resources

To encourage and educate homeowners and aspiring home buyers, Greenway offers free information and resources.

You can visit us online to learn more.

-

FREE First-Time Home Buyer eBOOK – Includes handy resources & checklists

-

First-Time Home Buyer RESOURCES – Check out our first-time buyer programs!

-

Home Buying Comparison Chart - Take this chart with you during your home search!

-

Buying Your First Home – Learn everything you need to know

-

Refinancing Your Mortgage - Get a free loan quote

-

Refinance Mortgage Calculator - Find out if it's time for you to refinance with our easy to use calculator

-

Renovation Mortgage Programs - Put your home improvement plan into action

-

Construction Loans - Can't find your dream home? Build it with a Construction Loan

-

Construction Loan Guide - Learn everything you need to know about construction loans and the process

-

Mortgage Calculators – We have an entire library of easy-to-use calculators!

-

Mortgage Terms – Get up to speed on some mortgage terminology

-

When Can You Cancel Your Private Mortgage Insurance? - Find out by using our easy calculator

-

Ready to get started? Apply Now using our online application.

|

|

|

|

|

|

|

|

|

|

|

|

.png)

.jpg)

.png)